New Delhi, July 2, 2012: The Indian telecom equipment industry has not quite shed its aura of gloom in doom: Its performance in fiscal year 2011 -12 was marginally lower at Rs 1.13 trillion (1,13,188 crore) in 2011-12 compared to Rs 1.14 trillion (1,14,133 crore) in FY2010-11. In other ways too, the industry barely maintained status quo, beset as it was, by the uncertainties -- much of it traceable to governmental inaction – that characterized the lurch towards 3G. According to the 2012 annual survey of the Indian Telecom industry by CyberMedia group’s flagship journal for the telecom industry, Voice&Data, nearly half of the telecom equipment revenue came from carrier equipment manufacturers, which saw a dip of 5.06% to touch Rs 553 billion ( Rs 55,333 crore) during the year. In the previous year, FY10-11, the segment had registered Rs 582 billion (Rs 58,285 crore) revenue.

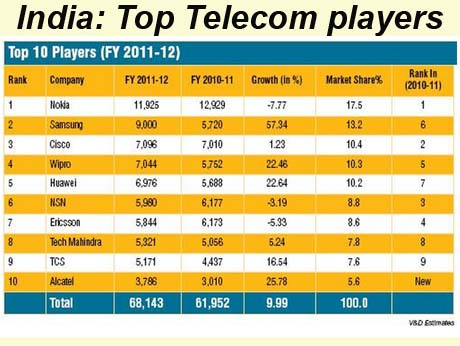

Mobile handset maker Nokia had the highest revenue during the year followed by Korean electronics major Samsung. They were followed by telecom equipment manufacturers like Cisco, Huawei, Nokia Siemens Networks, Ericsson, and Alcatel-Lucent. The Top10 club also saw inclusion of software companies like TCS, Wipro and Tech Mahindra(see illustration)

Voice&Data attributes the sharp decline in the carrier equipment revenues to policy uncertainty which restrained many telecom operators from releasing large scale network expansion orders. The Top 10 club also saw Samsung registering highest growth of 57.34% to capture the second position with revenues of Rs 9,000 crore, riding high on its smartphone and tablet portfolio.

Within the carrier equipment business, segments like transmission, telecom turnkey and wireless infrastructure were the biggest losers. Transmission segment dropped 21.88% to report revenues of Rs 3,825 crore (from Rs 4,896 crore last year). The telecom turnkey segment revenue dropped 65.27% to Rs 1,862 crore (from Rs 5,362 crore). The wireless infrastructure segment dipped 40.51% to record revenue of Rs 10,930 crore from Rs 18,374 crore a year ago.

The enterprise equipment business grew by 8.89% to reach Rs 23,183 crore in FY11-12 from Rs 21,291 crore in FY10-11. Enterprise cost saving equipment segments like audio-video conferencing and voice solutions showed significant growth of 16% and 15% respectively. Modem and router industry saw a negative growth as enterprises demanded futuristic and multi-tasking devices like single device working as modem, router and switch.

The17th annual survey, Voice&Data 100, covered over 500 telecom companies in India spanning carrier equipment, enterprise communication equipment, and user device manufacturers.

------------------------------------------------------------------

From Voice and Data's cover story by Gyana Ranjan Swain:

History Repeats itself It was 2011 déjà vu for the Indian telecommunications industry in FY12 and the erstwhile poster boy of Indian growth story offered us nothing more than a flashback of what happened in 2011. Same old story. The industry did not see much growth, lacked momentum, lagged in finalizing deals and the stakeholders wore a pale look throughout the year. As if the industry did nothing the entire year and was sitting idle.

Yes, to a great extent it was sitting idle. The hype of 3G wave expected to sweep across the length and breadth of the country, remained only in the air. And the operators who had put all their flesh and blood during the auction to get spectrum and licenses, did not do anything significant to reach the masses and lacked substantial 3G offerings. They did not expand their network as per the requirement, directly affecting the balance sheet of equipment manufacturers.