July 30, 2022: India’s Fintech growth story continued to hold strong in 2021, with a 157% y-o-y growth in funding.

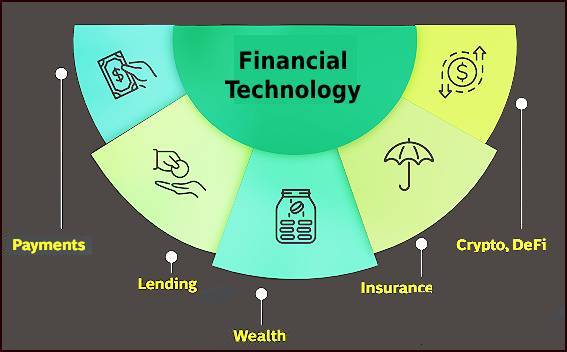

The sector received funding worth USD 8 Billion in 2021 led by payments at around USD 2.7 Billion closely followed by lending at around USD 2.6 Billion.

India’s digital payment success story is evidenced by the digital transaction volume of over 28 Billion2 and a gross value over Rs 320 Trillion in FY 20212.

Going forward, lending is likely to become even more valued given the democratization of data, and the valuation profile of Indian Fintechs is expected to shift from payments to lending.

These are key findings of the just released by the report by Boston Consulting Group (BCG) titled, ‘Past Perfect, Future Tense? - Themes shaping the future of Fintechs in India”.

Here are some more findings:

- Funding to fintechs witnessed a 30% (Y-o-Y) drop in the quarter ending June 2022; outlook on valuation mix expected to shift from payments to lending-led fintechs

- The infrastructural maturity of AA, OCEN, ONDC, NHS is set to democratize payments, credit, commerce, insurance

- Availability of machine-readable, standard-format data is set to explode by 100x and drive sharper credit decisioning to SMEs

- P2M payments expected to reach USD 2.5-2.7 Tn by 2026. driven by rapid deployment of QR codes, activation and adoption of the already acquired merchant base

- UPI-enablement of credit cards is set to further turbocharge UPI’s ubiquity in India’s digital payments ecosystem

- India’sBuy Now Pay Later ( BNPL) disbursements are expected to grow to INR 700,000 Cr. by 2026. The rise of embedded finance is expected to drive digital payments and credit penetration.

- Credit quality continues to be a key priority for Fintechs; through 2021, sections of portfolios sourced by Fintechs continued to demonstrate GNPAs of over ~20% of disbursements

- India’s wealth will continue to be increasingly financialized and drive penetration of equity investing, as Wealthtechs seek to activate mass investors through thematic product innovation

- IRDAI seeks to usher in a new regime of insurance regulations, which could unlock newer operating models, partnerships between Insurtechs and incumbents.

- The recent crypto market erosion (~70% fall in valuation of bitcoin and Ethereum) has tempered stakeholder expectations; capital will continue to be constrained whereas talent pool remains resilient.

Find the full BCG study here