In-depth look at past, present and future of the Indian television industry (extracted from the Telecom Regulatory Authority's recent consultative paper on Promoting Local Manufacturing in the Television Broadcasting Sector.

January 27 2022: The growth story of the television broadcasting sector in India is as fascinating as the content it delivers. The terrestrial broadcast of Television (TV) service in Delhi commenced on 29th September 1959 by the state-owned Doordarshan (DD). During the 1982 Asian Games held in Delhi, terrestrial broadcasting saw major expansion with DD adding 20 new transmitters to the existing 211 to provide national coverage for the first time. Asian Games also introduced color television broadcast in India.

Cable television came to India in 1989 with few entrepreneurs (Cable TV Operators) distributing local video channels that transmitted movies and music videos. Cable Operators usually confined their operations within small areas, such as a housing complex.

The advent of satellite television in India was triggered by the broadcast of the Gulf War in the 1990s. The coverage was done by the American news channel, Cable News Network (CNN) which in turn, drove the use of satellite dishes by the Indian cable operators for procuring CNN’s signals. The launch of Star TV and Zee TV in 1992 further stimulated the spread of cable TV.

By the end of 1994, M/s Frank Small estimated the numbers of cable and satellite homes at 11.8 million out of a total of 32.4 million TV-owning homes.

The Government brought a standard policy/regulatory framework for satellite broadcasters in 1999. The policy Up linking/Down linking of TV Channels encompasses the issues related to spectrum allocation, content regulation, and other aspects. Guidelines for Direct-to-Home (DTH) platform were issued in 20012, and DTH operations commenced in India in 2003.

With 901 TV channels, including 327 Pay TV channels4, offered by 357 broadcasters, the Indian TV industry is the world’s second-largest TV viewing universe across the globe after China. According to Media Partners Asia, there are 169 million TV households in India which includes 42 million Terrestrial/Free Satellite connections.

There are currently 4 Pay DTH operators functional in India, providing television services to a total of 69.57 million subscribers as on 31st March 2021.

Further, there are 17 registered Internet Protocol Television (IPTV) service providers. The total subscriber base under the IPTV segment is less than a million. However, with the increasing industry shift to convergence, the IPTV segment is likely to see significant growth in days to come.

Digital Addressable Systems (DAS)

DAS comprises a set of digital hardware (digital headend) and software tools used in satellite and cable TV industries for transmitting television channels in an encrypted form to their subscribers. At the subscribers’ premises, a set top box (STB) enables to view free, paid, or ondemand encrypted channels, as per the subscriber’s authorization based on the subscription. In a cable television network, authorization is given and controlled by the Multi System Operator (MSO), who owns the DAS but may work with different Local Cable Operators (LCO) in different markets.

Post deployment of DAS, the hardware deployed in distribution network can be broadly classified into the following three categories: A. Headend Equipment: like LNB (low-noise block downconverter), IRD (Integrated receiver/decoder), Encoder, Multiplexers (QAM for cable operators, QPSK for DTH operators), etc. B. Transmission Equipment: like EDFA, GPON OLT, Optical Fiber Cable, RF Cable, Outdoor Fiber Amplifiers, Signal Amplifiers, Power Distributors, Repeaters, etc. C. Consumer Premises Equipment: like Set Top Box (STB) and Optical Network Terminal (ONT), etc.

Digital headend comprises a set of equipment that accepts broadcast TV signals as input from satellites, processes them into cable-quality encrypted signals, and then transmits the combined feed to the local cable networks. A headend usually consists of an integrated receiver/decoder, encoders, trans-coders, channel modulators, channel processors, and channel signal combiner.

The distribution network is part of a cable television system that connects the headend of the system (video and media sources) to the consumer’s equipment. Most cable TV networks deploy RF-based HFC (Hybrid Fibre Coax) networks. Herein the last mile is a coaxial cable network; however, the long-distance transmission is on optical fibre network.

Consumer Premises Equipment: Apart from cables and accessories, the main devices deployed at consumers’ end are the Optical Network Terminal (ONT) (used in case of an optical fiber to the home [FTTH] connection) and Set Top Box (STB). A set top box (STB) is a device that receives a digital signal, decodes, and displays it on television.

Software

In addition to the equipment and hardware deployed in the network, certain key software components play a vital role in the broadcasting distribution chain. The Conditional Access System (CAS) is responsible for the encryption of content and its secure delivery to 15 authorized subscribers. CAS is at the core of the Digital Addressable System and is responsible for content security, entitlement management, and entitlement control for the content. The Subscriber Management System (SMS) essentially acts as the management centre for the CAS. The SMS is responsible for the activation/deactivation of STBs, managing subscriber information, channel information, billing, and other such activities.

Global trends of Manufacturing in Broadcasting. The global market size of broadcasting equipment is estimated to be at US$ 6.2. billion in 2021. The global market size has increased at 6.6% Compound Annual Growth Rate (CAGR) from 2017 to 2020. The figures are estimated to further register an exponential growth to US$ 15 billion by 2031 at 9.4% CAGR. (Source: Persistence Market Research)

+U.S. is said to be the biggest contributor and is estimated to have a market size of over US$ 1.6 billion in 2021.

The broadcast equipment market in India is also expected to witness growth in the years to come, driven by the steady rise in the demand for digital content across various broadcasting channels. In fact, India is considered as one of the top five countries driving demand for broadcasting equipment, along with the U.S., U.K., China and Japan.

The fast-paced digitalization of the Indian broadcasting sector specially in Television Broadcasting, provided a unique opportunity for the growth of local manufacturers to cater to the demand. However, the share of locally manufactured equipment/devices in the broadcasting distribution networks remains quite low. The implementation of DAS started way back in 2012. Even after eight years, most of the equipment and STBs are imported.

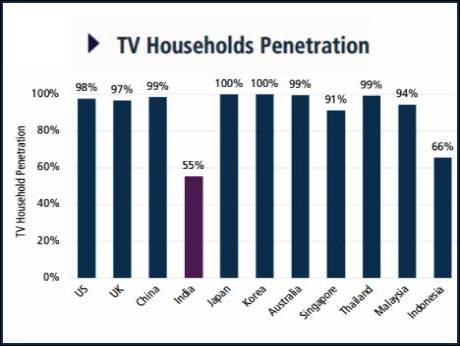

The television viewing universe in India has grown to the second-largest in the world. However, the TV penetration remains abysmal 55%, hinting that a large population still lacks access to TV. This implies that there is still a large untapped demand potential, providing an opportunity to meet such demand through local manufacturing

Link to the full TRAI Consultative paper