Bangalore, December 14 2021: The evolution of Global Centres of Excellence (GCoEs) from being cost centres to driving cutting-edge technology innovation for parent organizations has been a phenomenal journey.

While traditionally, only metropolitan cities such as Bangalore, Delhi-NCR, Hyderabad, Chennai, and Pune have been locations of choice for companies to set up their GCoEs, this trend has witnessed a transformational shift in the wake of the pandemic and the resultant reverse exodus that occurred.

Greater percentages of employees chose to return home than to stay in metros, given the remote work mandates and the hybrid work models that companies are increasingly adopting.

Zinnov’s analysis of ~300 emerging Indian cities reveals that more than 2 million relevant workforce in the IT, ER&D, and BPM sectors is currently residing in the top 15 tier-2 cities. Hence, in light of this paradigm shift and the global phenomenon, ‘The Great Resignation,’ the onus is on organizations to have a strategy to tap into these under-leveraged talent hotspots.

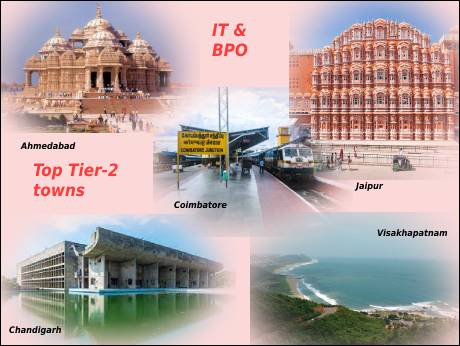

Rise of Tier-2 Cities

At the onset of the pandemic, several tier-2 cities began to emerge as beacons of resilience to ensure business continuity – especially when the lockdowns and restrictions of movement were at their peak in metropolitan cities. This, coupled with a plethora of conducive factors such as high cost arbitrage, booming infrastructure and smart city initiatives, emerging start-up hubs, a metropolitan lifestyle, favorable government initiatives, mushrooming co-working spaces, and an expanding GCoE footprint have further emphasized the attractiveness of tier-2 cities.

The mass reverse exodus during the pandemic accentuated the focus on the factors that make tier-2 cities appealing – both to employees as well as employers. This becomes all the more imperative as more and more companies adopt hybrid/permanent remote work models. Furthermore, the e-Commerce volume growth in tier-2 cities outpacing tier-1 cities in 2020, emergence of start-up hubs across tier-2 cities, access to better healthcare, less pollution, and overall well-being, and an ever-increasing GCoE/Service Provider (SP) footprint in these cities have further cemented the rising prominence and unmistakable potential that tier-2 cities hold. In fact, companies such as Mastercard, Bosch, Schlumberger, Franklin Templeton, Deutsche Bank, ABB, EY, Uber, Nissan, Bank of America, etc., already have their centres operational in these cities.

Tier-2 City Landscape

Among the ~300 emerging Indian cities evaluated for the study, Zinnov shortlisted the top 15 cities based on multiple parameters such as City Attractiveness, Ease of Operations, Ease of Doing Business, Connectivity, Talent Availability, Migratable Talent, Cost Index, Climate, and Safety, to name a few. The top 15 cities include Ahmedabad, Coimbatore, Chandigarh, Jaipur, Visakhapatnam, Indore, Kochi, Bhubaneswar, Nagpur, Vadodara, Surat, Thiruvananthapuram, Mysuru, Madurai, and Goa.

Ahmedabad, Coimbatore, and Chandigarh hold the pole position across parameters, with significant installed talent and the number of GCoEs currently operational. Ahmedabad houses the highest niche talent pool of ~10K and the highest migratable talent, which has been possible due to accelerated digitalization and remote working opportunities. Coimbatore has the highest number of engineering colleges, which translates to a consistent supply of fresh STEM talent, and migratable talent due to emerging IT and ER&D hubs being set up there. Chandigarh, on the other hand, has a strong education system with ample schools, colleges, and research institutes.

The Zinnov study highlights that the southern cities of Coimbatore, Kochi, Madurai, and Thiruvananthapuram have improved their City Attractiveness over the last year, significantly moving up in the rankings. Additionally, Beyond Bengaluru, an initiative by the Government of Karnataka is a concrete step in the right direction, which will help firm up the state’s foothold in the IT sector beyond the borders of the Silicon Valley of India. In fact, cities such as Mangaluru, Mysuru, Belagavi, Hubli-Dharwad, and other areas have a great thrust on education and infrastructure, with the potential to attract future investments and employment opportunities.

Speaking about the study, J C Vishwanath, Principal, Zinnov, said, “The talent wars have reached a pivotal point post-COVID-19, which have been further exacerbated by ‘The Great Resignation.’ As global leaders struggle to identify the right talent hotspots, tier-2 cities in India have emerged as veritable hubs of under-tapped talent skilled in ER&D and IT functions. Additionally, with many companies optimizing their expansion footprint by building completely virtual teams, and mandating employees to go to office on a need basis, it becomes a win-win to not only leverage the under-tapped talent in tier-2 cities but also set up outpost centres for brainstorming sessions and critical in-person client meetings.”

“With cities like Ahmedabad, Coimbatore, Chandigarh, etc., emerging as potential talent hotspots, organizations need to make deliberate and definitive efforts to realign their talent strategies to focus on tier-2 cities for skilled yet affordable talent. Although the reverse migration to tier-2 cities was triggered by the pandemic, we believe that with widespread adoption of remote/hybrid work models, these cities will increasingly become destinations of choice for organizations to expand their footprint, while also enjoying cost advantages.”

Founded in 2002, Zinnov is a leading global management and strategy consulting firm, with presence in Santa Clara, Houston, Bangalore, Gurgaon, and Paris.