June 11 2021: Leading Indian fintech company, Zaggle, has announced its entry into the neo-banking space last week.

The company had launched the initiative through its group company, ZikZuk to address major challenges faced by SMEs.

The first product that is being launched is the Founders Card – a credit card for SME owners under its group company ZikZuk. The company is aiming to clock in a revenue of Rs. 250 crore (Rs 2.5 billion) in the first one year of business. As a part of its growth strategy, the company aims to reach out to one lakh (100,000) SME’s in the next 2 -3 years. ZikZuk learned about the challenges faced by Founders to access credit, to meet their business expenses and also manage their working capital. Hence, it will be focused on making easy and timely availability of credit to the SME segment to address their financing and liquidity issues.

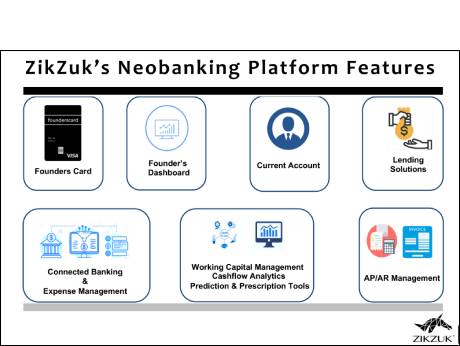

The three primary products that will be a part of this initiative:

Founders Card – South Asia’s first business infinite credit card curated for the needs of the SME owners and Founders that takes care of their business expenses and credit requirements.

Business Finance Manager, a financial operating system that manages the entire business finance for SMEs including AR/AP management, cash flow management, working capital management, Inventory management etc. and suggests best possible options available to foster growth of the business.

Multibank Account Aggregation: Aggregates current and savings accounts of SMEs on one platform to: Check Account Balance, Make Fund Transfer (NEFT, IMPS, RTGS), View & Download Account Statements, View Recent transactions and View Categorization/Segmentation of transactions