April 1 20221: Hitachi, Ltd. has announced that it will acquire GlobalLogic Inc. (President and CEO: Shashank Samant), a leading U.S.-headquartered digital engineering services company.

The acquisition is based on the definitive agreement among Hitachi Global Digital Holdings Corporation , a U.S. subsidiary, an SPC established by HGDH for the acquisition and GlobalLogic Worldwide Holdings, Inc., the parent company of GlobalLogic. The transaction is subject to customary conditions and regulatory approvals and expected to be completed by the end of July 2021.

Through the acquisition, Hitachi expects the addition of GlobalLogic's advanced digital engineering capabilities, and its solid client base including major technology companies, to strengthen the digital portfolio of “Lumada.”* Hitachi Vantara LLC, a U.S.-based subsidiary of Hitachi and its digital infrastructure, data management, and digital solutions business, plays a key role in driving Lumada business growth in the global market.

The acquisition will create synergies across Hitachi’s five sectors – IT, Energy, Industry, Mobility and Smart Life – and automotive systems business (Hitachi Astemo) by accelerating the advanced digital transformation of social infrastructure such as rail, energy, and healthcare at a global scale. Through its Social Innovation Business delivered by collaborative creation with customers, Hitachi aims to increase social, environmental, and economic value for its customers and realize a sustainable society.

------------------------------------------------------------------------------

'Unprecedented': Zinnov

Comments from Zinnov, a leading global management consulting and strategy advisory company.

Hitachi’s acquisition of GlobalLogic is a completely unprecedented move, that too at an inordinately high valuation of USD 10Bn. Zinnov’s continued predication about the potential of the Digital Engineering Services market has been firmly anchored by this deal which is an indicator of the buoyancy and the big bets that companies and investors alike are making in this space.

Hitachi Acquiring Global Logic for ~ USD 10 Billion heralds Digital Engineering as the future of the Technology Services Industry GlobalLogic is poised to tick all of the important boxes that companies and enterprises are looking for in terms of capabilities and prowess from a Digital Engineering Services perspective, and has hence secured a striking valuation of USD 10 Bn at about 10X revenue, 30X EBIT multiples.

Top global Digital Engineering Services firms such as EPAM and Globant are also valued similarly. This category of companies also includes names such as Persistent, LTTS, and respective divisions within Wipro, Infosys, Accenture, Capgemini, and Cognizant.

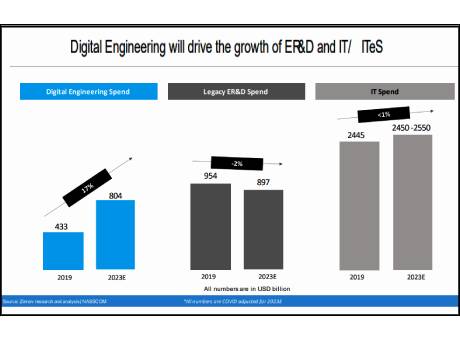

Despite COVID, Digital Engineering investments continue to boost ER&D spending and is expected to grow at 17% CAGR through 2023. This shift is more pronounced as the spend on legacy initiatives is expected to stay flat during the same period.

Manufacturing industries bore the brunt of the pandemic and this translated into corresponding ER&D budget cuts. However, manufacturing firms have found steady ground by refocusing budgets on Digital Engineering investments. The digital thread is already transforming the way products are designed, manufactured, and serviced. Smart manufacturing has already become table stakes for every vertical.

Hi-tech verticals stayed relatively immune and were buoyed by demand in certain pockets (cloud & collaboration, OTT, software-based network architecture, etc.). ER&D spending by GAFAM (Google, Amazon, Facebook, Apple, Microsoft) is in excess of USD 100 Bn and will grow at a CAGR of 16% to touch USD 172 Bn by 2023. GAFAM firms continue to invest in Digital Engineering initiatives outside their core areas to derive alternative sources of revenue, and thereby, present opportunities across multiple verticals to the Service Provider (SP) community.

Services-led verticals such as BFSI, Healthcare, and Retail showcased high levels of Digital Engineering[1]led innovation to stay afloat, and ensure continuity during the pandemic:

• Disruptive forces have been driving the digital transformation spend in the BFSI sector. With COVID, digitalization has further come to the forefront as banks witnessed a surge in demand for digital channels and products. In fact, Digital Engineering spend by BFSI enterprises will grow 1.6X in the next 3 years and touch USD 93 Bn by 2023.

• Due to COVID, retailers have blitzscaled their digital transformation initiatives and invested 3 years’ worth of digital transformation spend in 6 months. The Digital Engineering spend by retailers will touch USD 53 Bn by 2023.

• Uber-ized patient care is the biggest COVID-led disruption in the Healthcare space. In fact, the share of consumers using telehealth services will increase 5X over the next 3 years. Digital Engineering spend by Healthcare payers and providers will account for USD 45 Bn by 2023.

On the other side, enterprises across verticals that are looking to incorporate antifragility in their DNA, will further channelize their investments to build intelligent products and ingrain smart operations in a post-pandemic world. This unabated secular focus on leveraging next-generation tech such AI, AR/VR, and IOT as a means to build antifragile ecosystems will translate to a 17% CAGR growth in Digital Engineering spending through 2023. In fact, Digital Engineering will account for USD 804 Bn or 47% of the total USD 1.7 Tn ER&D spending in 2023.

Accenture has made over 180 acquisitions in the last 5 years. The company has spent USD 1.86 Bn in 2018 and 2019 on these acquisitions and planned to spend another USD 1.6 Bn last year to scale what it terms, Industry X.0. 80% of these acquisitions are in Digital/Engineering and housed under the Industry X.0 umbrella. Capgemini has taken a big bang approach by acquiring the hitherto largest Engineering company in the world – Altran (about USD 3 Bn in revenue) – a deal that was completed just a couple of months ago. Cognizant has also taken giant strides in this area, with its acquisition of Softvision in 2018, which has now become the vehicle to drive growth in Digital/Engineering. Companies like HCL and Tech Mahindra have also been making steady acquisitions in this space, including a few this year.

See related report on India engineering services market