Bangalore; March 13, 2021: Despite the significant increase in the adoption of digital technologies over the past few years, there is a continued lack of technology expertise and digital fluency in the boardrooms of the world’s largest banks, according to a new report from Accenture.

Building on a similar report from 2015, the new report, “Boosting the bank board’s technology expertise,” is based on an analysis of the professional backgrounds of nearly 2,000 directors of more than 100 of the world’s largest banks by assets. It finds that while banks are ramping up their technology investments to keep pace with changing consumer demands ― such as the growing need for digital interaction and remote working as a result of the COVID-19 pandemic ― their boards of directors lack the technology expertise to minimize the risks and maximize the benefits of their technology investments.

“Much of the disruption brought about by the pandemic has led to a rapid shift within banking to more digital touchpoints, requiring speedy technology investments,” said Mauro Macchi, who leads Accenture Strategy & Consulting in Europe. “Banks that are accelerating their cloud adoption to better manage change would benefit from a board with technology experience that can help ensure that technology investments are compatible across various business units.”

Accenture recommends that 25% of banks’ board directors should have technology experience. While the world’s largest banks have made progress on adding technology experience in the boardroom ― which Accenture defines as executives holding or having held senior technology positions at a company or senior responsibilities at a technology firm ― that progress has been slow.

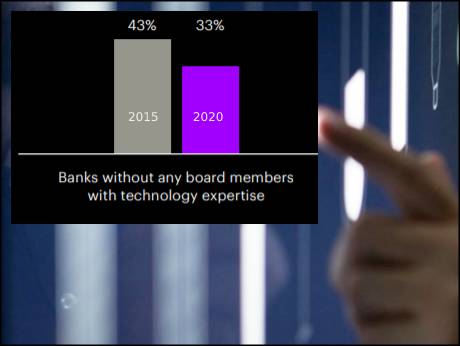

For instance, only 10% of all board directors, as well as 10% of the CEOs on the boards, evaluated for the report have professional technology experience, up just 4 and 6 percentage points, respectively, from five years ago. In addition, the number of banks whose board has at least one member with professional technology experience has increased only 10 percentage points in the past five years, from 57% to 67% ― meaning that one-third of banks still have no board members with professional technology experience.On a positive note, while only 19% of the directors with technology experience five years ago were women, that figure has increased to 33% today.

-----------------------------------------------------------------------------------------------------------------------

Indian issues:

Indian regulator proposes stricter rules on independent directors

Independent Directors: Three-fourths central public sector undertakings flout norm

-------------------------------------------------------------------------------------------------------------------------

From a geographic perspective, the report found that the boards of banks in the U.K., Finland, Ireland and the U.S. have higher percentages of directors with professional technology experience than those in other countries, with sizeable increases compared with the 2015 findings. However, the percentage of banks’ boards of directors with technology experience is still very low in Brazil, China, Russia and various countries across Europe, including Austria and Italy.|

“While it’s not practical for banks to make a rash number of tech-savvy board appointments to fill the gap in technology credentials, they should consider technology expertise as a factor for new appointments, alongside their other evaluation criteria,” Macchi said. “There are also other, more immediate ways to increase technology expertise among board members — for example, coach members on the latest developments on key technologies such as cloud, artificial intelligence and the internet of things to better understand how the combination of technology and human ingenuity unlocks value. Boards can also tap into the expertise of third-party suppliers and make time to specifically discuss the technology strategy during board meetings to get the most out of their investments.”

The full report can be accessed here.