People bought fewer tablets in 2016, than the previous year -- and the number of vendors has drastically shrunk

Bangalore, March 6 2017: When tablet PCs came some five years ago, every one predicted they would be the big laptop killers -- smaller, lighter and able to do much of the same thing. How wrong they were! There was a portable PC killer at work, but tablets were innocent of the mayhem. The threat came from an unexpected direction -- the smartphone, or rather its larger avatars, 6 inches or more in size. The models that were 6.5 inches were even called phablets -- phone-tablets. People who bought phones ten years ago for their ultra portability, no longer minding lugging a large device that could no longer fit in your jeans pocket, unless you re-stitched it. They no longer minded using two hands to operate the phone in landscape mode -- to view video.

But there was a subtle lakshman rekha: A 6-inch or 6.5-inch phone? Cool! A 7 inch phoning tablet? Nah!

Two industry surveys both out last week, agree that the tablet market is in a (hopefully temporary) decline in India:

International Data Corporation (IDC) and Cyber Media Research (CMR) agree that in 2016, Indians bought between 3.5 million and 3.7 million tablets. IDc calls it a 3.1 percent decline over 2015.CMR says it is 18% down. The differerence may be in what we consider a tablet today. IDC includes a slate like Microsoft's and some detachable tablets ( with separate keyboards).

At any rate both agree that the last quarter of 2016, was a killer -- chalk up another scalp to the belt of demonetization.

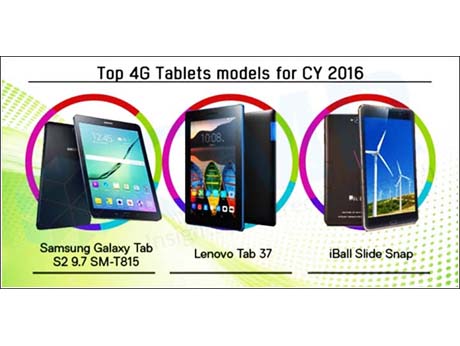

Detachable in fact could be the saviour in the future. Says IDC India's Senior Market Analyst, Client Devices, J Karthik: “India’s declining tablet market saw few emerging trends in 2016. Detachables category grew annually by a healthy 30.7 percent driven by demand coming from both consumer and commercial segments. Detachables shipments is led by Acer which accounted for almost one fourth of the product category followed by Apple’s iPad Pro. 4G based tablets ramped sharply accounting for almost one fourth of total tablet shipments in 2016 against a mere 6% in the previous year.” He adds another sliver of hope: “Recently, there is an increase in adoption of larger screen tablets in commercial segment we expect this to grow further in coming quarters."

According to IDC the top tablet vendors in 2016 were: Data Wind 27.6%, Samsung 16.3%, Lenovo 13.4%, iBall 12.8% and Micromax 9.7 %.

CMR's take is similar but it finds another Indian maker in its top line: DataWind 34%, Samsung 18%, Pantel 12%, Micromax 10%.|

DataWind the clear leader has interesting marketing practices. You might remember this Canada based, Indian talent-driven brand that made the first model of the Aakaash tablet. Says Menka Kumari, Analyst at CMR: “Iris-enabled and biometric tablets will see a bigger uptake in 2017. Datawind will continue to enjoy number one position on the back of its expansion spree. The company is entering into strategic tie-ups with mom-and-pop stores to expand its reach.She also suggests that tablets will bundle data in their offers, like phones do today.

There were 22 tablet makers a few years ago.Today there are less than a dozen. ". The market is moving towards a consolidation phase and 2017 will see further shrinkage with only 6-7 serious players remaining in the list", says CMR.

Even so there is a future for tablets only as specialist devices: "While smartphones are taking care of the masses, the tablets industry should cater to particular segments and customized their specs accordingly. For example, applied usage of tablets holds massive potential in retail, Quick Service Restaurants, healthcare and for cab aggregators and, therefore, the vendors should come out with specified specs such as heavy batteries, to cater to the demand of that particular segment. In the absence of any such initiatives, the market would remain stagnant in 2017 too."