No PIN or OTP -- even a phone is not required by Aadhaar number holders to transfer to receive money. But they need to have a linked bank account

Bangalore, December 27 2016: Of the four government supported e-payment options, the one which is relatively hassle free and does not require the customer to even carry a phone, is the one fueled by Aadhaar. The Aadhaar Enabled Payment System, was due to be formally launched on December 25 as part of the DigiDhan Mela held in Delhi. But it did not happen. Clearly some of the infrastructure is not in place, but considering the government's need to wean people away from dependence on cash, formal launch should happen any time now.

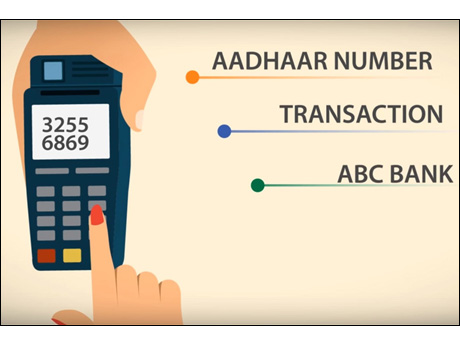

Through AEPS you can get money without producing any paper or card and don't need a mobile phone. However, your Aadhaar number should be registered with your bank account.

The customer feeds his or her Aadhaar number, scans any finger on the biometric device attached to the merchant's phone or point of sale device and , approve the amount to be paid. The payment will be transferred from customer account to merchant’s account. The customer need not share bank account details as the application will detect the bank account linked to the Aadhaar number with help of Unified Payment Interface (UPI). All you need is to remember your Aadhaar number and bank name. Details here.

In principle this is a compelling option, since over 1 billion Indian residents have an Aadhaar number. The challenge is for merchants to equip themselves with an Aadhaar authetication device -- either a finger print scanner or an iris scanner. The former is available for less than Rs 2000. An Indian player -- Biomatiques -- is only one of a dozen companies worldwide offering a portable iris eye scanner -- and its design has received the Standardisation, Testing and Quality Certification (STQC) from Department of Electronics & Information Technology (DeitY).

The iris scanner is available at almost the same price as a finger print device. Right now you mostly see fingerprint scanners at places where Aadhaar authentication is done -- for example by Mobile service providers before issuing a new SIM, because it is more convenient. But when it comes to rolling out a huge solution that will be widely used for financial transactions, is it enough? An iris scan is virtually unique to one person -- and unlike a fingerprint, does not deteriorate with age or as one does manual work. Government is not at present mandating one or the other.

The other option is to use the finger or eye scanners that are part of many smartphones today -- as part of the phone's access and security system. In principle these identifiers canbe used for Aadhaar authentication -- but there are practical hurdles. The phone's software would need to be changed; the eye or finger data would need to encrypted before being used for the Aadhaar application. Filters associated with the phone's scanner might need to be improved -- and the app would need to link to the national Aadhaar data base. None of this is a trivial task -- so don't expect to do Aadhaar self authentication on your phone any time soon.

|Meanwhile we have to wait for the formal rollout of AEPS and even when that happens, the scheme will be only as ubiquitous as the number of merchants who invest in an iris or finger print scanner. Why should they -- when an e-wallet like PayTM will work as well with no additional expense except a phone that every one already has?

One can see Aadhaar based payments making an impact with customers who may not even own a phone. Meanwhile for most of us this is yet another e-payment scheme that is jostling for our attention in these cashless days.