Study reveals Pune vies with Bangalore for research crown --pay wise Technology bigwigs tell you, they don’t put brakes on research even in bad time; in fact India-based IT multinationals made sharp cuts in the funding for R&D during the last 12 months and while average salaries of researchers may claw back, it would still be less than 4 percent more, finds a study by Zinnov Management Consulting. Its annual report titled, ‘Compensation and Benefit Study 2010’ ( focused MNC R&D centers in India) examines how Compensation & Benefits are shaping up post recession and what are the global changes and its impact on the centers in India.

The study reveales that the R&D spend growth went down significantly in the last 24 months with software/ internet, telecom/ networking, semiconductor and industrial automation witnessing a downward slip of 5 % to 10%. While the economy is starting to show signs of upward movements, the recovery in the R&D growth has so far been only ‘minimal’.

Pari Natarajan, Zinnov's CEOsays, “As the cost pressures continue to exist, we foresee companies trying to execute more R&D work at the same or even lesser budgets as compared to last year. Companies would be forced to focus on new growth engines in the form of emerging markets (such as India and China) and newer technologies (such as SaaS/ Cloud). And this will fundamentally push all R&D centers to deliver higher value & higher productivity at lower costs”.

He adds: “We also see that this demand for cost control will force R&D centers in India to put a check on the salary escalations for the next couple of years”, he added.

The study suggests industry will see an average salary increment between 6% - 10% this year based on their growth at the India center and global performance of the company. It adds that companies will be forced to offset low hikes by creating more responsibility areas, increasing ownerships and defining attractive career path to retain critical resources. While companies will be cutting down on salary increments, the ever increasing experience pool will continue to put lot of pressure on costs.

Zinnov does not expect the average attrition figures for the year to go beyond 9%.

Hiring will continue to be slow and selective, highlighted the study. While the availability of talent pool will continue to exist, companies would be going slow on hiring and would only be looking at backfilling existing positions and selectively hire at new positions based on requirements. Campus hiring will be slow as deferral hiring from last year resulted in late joining for many fresher, it added. Companies would only maintain their existing working relationships with the universities and hire minimally from campuses.

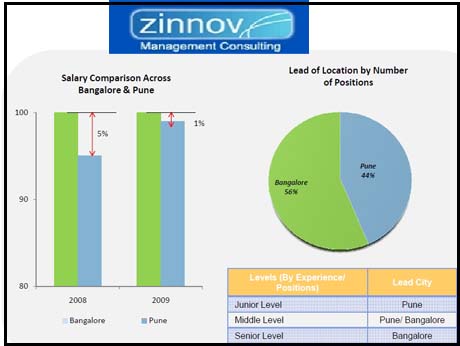

In the drive to optimize costs, many R&D centres would also explore opportunities with tier 2-3 cities in India to execute some non-core functions at these ultra low-cost destinations. A result of this focus on tier 2-3 locations is a fact that 43 tier 2-3 locations are emerging as IT hubs in India, thereby reducing pressure on tier 1 locations, the report highlighted. Interestingly , Pune is fast catching with Bangalore as an innovation capital – going by salaries paid in the R&D area: In 2009 they were just 1% behind Bangalore. The southern city accounts for 56 % of R&D positions to Pune’s 44 %.

Zinnov also sees third party providers assuming increased responsibilities with mature/ sunset products in arrangements such as risk reward, revenue share and outcome based pricing. Mid-sized companies are also now likely to benefit as the service providers augment their focus on the long tail of product companies in the drive to explore new growth engines for their respective growths.

Linky to Zinnov: www.zinnov.com