New Delhi, India: March 29, 2016: A global security survey by IEEE, the world's largest professional technology organization reveals a major shift away from cash to virtual financial transactions .

More than 1,900 technology enthusiasts' views on digital safety and the future of cybersecurity were tapped for the online survey. When asked what year mobile payments would be secure enough to the point where traditional methods (such as cash and credit cards) would no longer be required, 70 percent of respondents indicated a major shift by 2030. The survey results also found, on a scale from 1-5 (1 being least concerned to 5 being most concerned), a similar percentage between the lack of concern regarding the security of work email (50 percent) and personal email (49 percent) accounts, which is surprising given that there is no dedicated IT department to monitor and protect personal email as there is for a work-affiliated account.

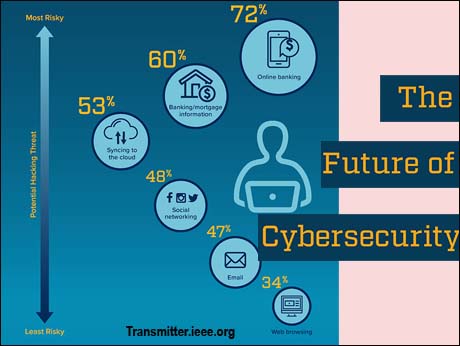

More than one quarter (26 percent) of participants also noted that the cloud was the least preferred method for storing their information; 49 percent of respondents chose personal computer log as their primary option. Respondents did have concerns regarding other considerations to their digital footprint. When asked on a scale from 1-5 (1 being riskiest to 5 least risky) about their personal information being available on certain platforms, respondents believed that online banking (72 percent), syncing to the cloud (53 percent) and banking/mortgage information (60 percent) were extremely risky, indicating a 1 or 2 for each.

"Now more than ever, cybersecurity is a necessary safeguard to our digital lives, which hosts a variety of our private and personal information," says Diogo Monica, IEEE member and security lead at Docker. "Cyberattacks can now unfortunately happen in nearly every element of our lives, such as our car, connected home and wearable devices. Whether it's putting more reliance in digital systems for our currency or trusting that our email accounts are secure, we need to be cognizant and take the necessary precautions to protect our digital footprint."

There is a level of sophistication among respondents who monitor their home Internet activity. According to the results, 22 percent of respondents have automated alerts set up for any attempted connectivity, 11 percent utilize visualized monitoring in real-time and 3 percent connect to a cloud monitoring system. When asked what would be most affected by the continued developments of cybersecurity, participants noted identity theft (42 percent), followed by online anonymity (27 percent), piracy (18 percent) and viruses (12 percent).

Find a visual representation of the survey results here.