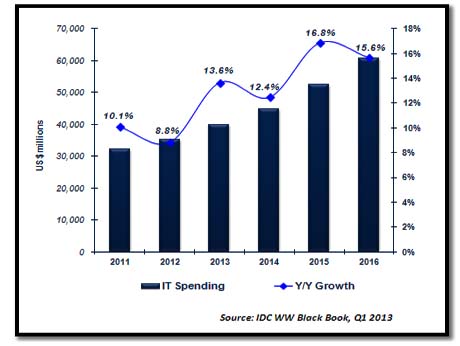

Bangalore, June11, 2013: Analysts International Data Corporation (IDC) has suggested in a recent study that IT spending in India is slated to grow to $ 44.8 billion by 2014, a 10 billion increase in two years.

In Its research report, “India IT Market Overview, 2013-14” IDC, says this is a opportunity which opens the door for rapid revenue growth for IT vendors of all hues.

Adds Jaideep Mehta, Country General Manager at IDC India, “We specifically see rapid growth in three growth vectors: emerging Tier II and III cities, emerging segments such as the upper mid market, and emerging verticals such as education and healthcare”.

India continues to be in choppy economic waters currently, characterized by a weak investment environment, depreciating rupee and tight credit conditions – these factors are causing companies to spend frugally. However, the impact of economic reforms in early 2013 such as relaxation of FDI regimes in select industries is expected to drive inbound investments and have a broader positive impact going forward. India's strong fundamentals—high savings rates, rapid workforce growth and expanding middle class—will continue to support brisk economic expansion in the mid to long term.

The infusion of new technologies such as the Cloud and Enterprise Mobility, new devices such as Tablets and innovative service offerings from the industry are also triggering spend on IT programmes, both in the Enterprise and Consumer markets.

Says Ravi Sharma, Research Manager, Consulting Group, IDC India: "India's favourable demographic dividend will continue driving consumer spending on IT products (client devices and smartphones). Government and Enterprise IT investments will move into fast track mode post the elections – a lot will depend though on the new government's political and economic agenda."

Key Highlights of the report: (All the growth rates CAGR from 2011 to 2016.)

• Hosted Application Management and Hosting Infrastructure Services are expected to lead the demand for IT Services with a CAGR of 17-19%, followed by Network Management, Application Management, Desktop Management and Network Consulting & Integration that also experience good traction at 12-14%. IT Services, overall, is expected to grow at 10.3%.

• Packaged Software registered a healthy increase in 2012, and is expected to further increase at the rate of 10.8%. Among the IT hardware categories, smartphones and networking devices present considerable potential with above-average growth rates.

• The Market Size (in USD) of most verticals (with the exception of Education, Utilities and Healthcare), contracted in 2012 due to the general negative sentiment for IT investments and partly due to the depreciation of the rupee. Utilities and Healthcare verticals are expected to lead the traction in IT investments with a CAGR of more than 15%, while most other verticals hover around 10-12%.

• Consumer spending on IT has been very strong and is expected to grow at around 26%. Shipments of Smart Connected Devices (SCD) in India are estimated to grow at an impressive rate of above 40%.

• 41% of Enterprise IT spending in 2012 was by SMEs. This proportion is expected to increase to 43% by 2016.