Reduced import duties may see US EV leader Tesla finally entering Indian market

Anand Parthasarathy

A survey by Bloomberg last week points to the irony that among 31 countries which have crossed the tipping point for mass usage of electric vehicles (EVs), high-tech countries like the US, Japan and Korea which have what it takes to be front runners, are in fact laggards.

On the other hand, a country like India which faces challenges to large-scale shift to EVs, is nevertheless poised to cross the tipping point as EVs reach price parity with petrol and diesel vehicles.

Also last week, a separate survey by Counterpoint Research, finds that EV sales in India nearly doubled in 2023 and are poised to rise by 66% this year and account for 4% of all passenger vehicles sales.

The accepted tipping point according to industry experts is 5% of new cars going electric – after that everything changes. And India may hit this number soon, driven by continuing government subsidies and a choice of new makes available: no mean achievement considering the obstacles –low per capita income and a disproportionately large rural hinterland.

A follow-up feature from Bloomberg, tries to understand why the US and a few others who are well positioned, are still EV let downs.

Japan has a vested interest in going slow with EVs, its priority is Hydrogen cell-based vehicles. “Japan’s slow adoption of EVs traces back to a bet made a decade ago by Tokyo technocrats and Japanese automakers to invest heavily in hydrogen fuel-cell technology. Toyota Motor Corp., the world’s largest carmaker, has since been a frequent EV sceptic.. lobbying against government policies that promote them around the world.”

South Korea has practical hurdles: “Many Koreans live in high-rise residential apartment complexes, and don’t have reliable access to at-home chargers.” This is in spite of Korea being the home of leading EVs world-wide: Hyundai Motor Group and Kia Corp.

As regards the US: “Even though sales of fully electric vehicles (make) up more than 8% of new car sales in the fourth quarter, the trend has been slower than the 20 countries that came before the US.” Other reasons: high prices, a lack of EV variety, and anxiety about the availability of public chargers. And one overriding brake on EVs:

“America’s biggest holdup has been its obsession with battery range. US drivers demand more range than drivers from any other country.”

Tata dominates in India

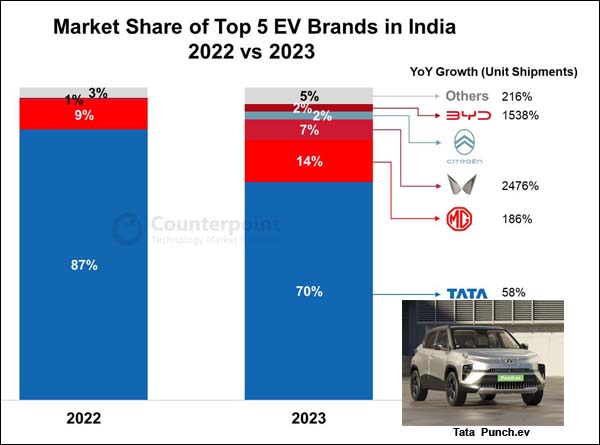

The April 5 announcement from Counterpoint Research based on its study of India’s EV Market, rates Tata Motors as the dominant player with 70% of the market share. It offers multiple models -- Nexon, Tiago, Tigor, Punch. With just one model, the XUV400 SUV, Mahindra & Mahindra was the fastest growing brand in 2023, recording a 2476% increase in just one year, followed by Chinese brands BYD and MG Motors.

Maruti Suzuki’s entry into the EV market is expected to challengeTata’s dominance. Moreover, VinFast, the Vietnamese brand’s move to build a factory in India’s Tamil Nadu state points to the growing interest and investment in EV manufacturing in the country.

Long waiting in the wings and now poised to enter the Indian market after some recently announced cut in import duties for up to 8000 cars in one year ,is the US EV leader Tesla. The German plant of Tesla was noticed to be making right-hand drive cars, which led Reuters to suggest this could potentially be for the India market. However, lower duties require the importer to invest around $ 2 billion in India which would indicate some indigenous manufacture.

Says Counterpoint Research's Associate Director Liz Lee: “India’s EV landscape is on the cusp of significant growth. The rise in EV battery manufacturing, supported by key players like Ola, Reliance New Energy and ACC Energy Storage, alongside the Make in India initiative, will lower manufacturing costs and boost EV sales. Government initiatives such as the PLI scheme for Advanced Chemistry Cells (ACC) and the recent reduction in import duties on EVs under $35,000 to 15% are game changers.”

This has appeared in New India Abroad