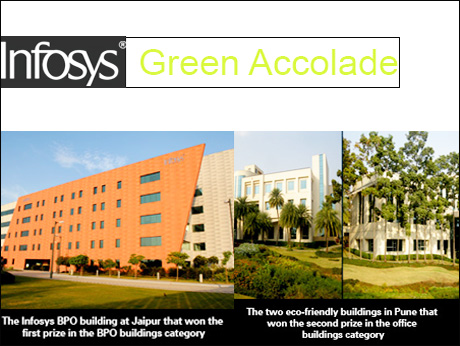

Bangalore. December 27, 2012: Infosys has been awarded the National Energy Conservation Award 2012 for its energy conservation efforts at the company’s campus in Jaipur and Pune. Infosys BPO building in Jaipur received the first place in the BPO Building category, followed by the two Infosys buildings in Pune which won the second place in the Office Building category. The President of India, Pranab Mukherjee presented the two awards to Swami Swaminathan, Managing Director and CEO, Infosys BPO and Rohan Parikh, Head of Green Initiatives and Infrastructure at Infosys.

The National Energy Conservation Awards from the Government of India, Ministry of Power, recognize innovations and achievements for efficient utilization and conservation of energy, in various sectors including industry, building, aviation, and municipalities among others.

The winning buildings at the company’s Jaipur and Pune campus take forward the focus on setting high benchmarks for energy conservation across the company. These buildings incorporate a host of energy saving features including insulated walls, energy-efficient lighting design with sensor-based fixtures, optimized Heating, Ventilation and Air Conditioning Systems, Building Management Systems, and high-performance glass among others.

Green Initiatives

Infosys has taken many steps during the past four years to become sustainable in their operations. The company is working to reduce its per capita electricity consumption by 50 percent from 2007-2008 levels and to sourcing all of its electricity needs from renewable resources by the end of 2017. Between 2007 and 2012, Infosys reduced its per capita electricity consumption by more than 32 percent. The company’s per capita water consumption declined by 23 percent and per capita GHG emissions dropped by 25 percent during the same period. The company encourages employees to endorse sustainable practices that reduce their daily consumption of resources. Infosys Eco Clubs are passionate partners in these efforts. The company is currently applying for more than 5 million square feet of LEED/GRIHA certifications. Read more on Infosys sustainability initiatives 2011-12 here.