China scoops up all the big R&D growth; India tapped far below potential.

Leading Management Consulting Zinnov Management Consulting, has released its report on R&D spending titled, ‘Global R&D Benchmarking 2010’’. The study targeted at the MNC R&D centers in India, brings to light that for the first time in six years, global R&D spending has decreased, however, this decline is much lower than the decline in net sales, which indicates the strategic importance of R&D.

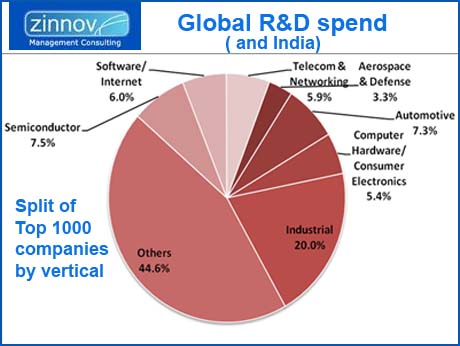

Companies headquartered in APAC were the only ones to increase their R&D spending, with the contribution being more than 10 percent of the global R&D spending at PPP. The Top 500 R&D spenders account for close to 90% of the total corporate R&D spending in the world with the majority of investments coming from North America (NA) and Europe (EU). Says Pari Natarajan, Chief Executive Officer, said, “Our study showcases that only about 27% of the top 1,000 R&D spenders have a centre in India, in fact in some verticals, less than 20 % of the companies headquartered in APAC, EU and Japan have an India R&D center. India still accounts for a small proportion of the total R&D investments by global companies despite having a strong talent pool across verticals”.

“We have noticed that only a few large centers have been set up in India, with most of the centers having an employee headcount of less than 300. We very strongly feel that there is indeed a lot of scope to expand for optimization”.

Bullet Points:Global R&D spending has declined/ decreased; however, this decline is much lower than the decline in net sales, indicating the strategic importance of R&D. Companies like Nokia, Sony, Daimler, Panasonic and Robert Bosch, have only slightly reduced their R&D spending even though net sales has taken a big hit in the last year

The Top 500 R&D spenders account for close to 90% of the total corporate R&D spending in the world; only three of the top 10 R&D spenders in 2009-10 were from North America

Companies in the APAC region continued to increase their R&D investments against the prevailing trend of reducing R&D spending followed by companies in other geographies

North American companies are the largest contributor towards software product/ internet R&D with Europe coming a distant second

Consumer Electronics/ Computer Hardware companies are majorly concentrated in the Japan and Asia-Pacific region

Telecom & Networking vertical witnesses significant contributions from all sizes of the companies, though mainly in North America & Europe

Japanese and European corporations account for more than 80% of the R&D spending in the Automotive vertical

INDIA: Only about 27% of the top 1,000 R&D spenders have a center in India; in some verticals, less than 20 % of the companies headquartered in APAC, EU and Japan have an India R&D center

India still accounts for a small proportion of the total R&D investments by global companies despite having a strong talent pool across verticals. Only few large centers have been set up in India; most of the centers have an employee headcount of less than 300 and there is scope to expand for optimization

North America dominates software R&D; though most R&D centers in India are mature, the need for diversification may increase competition from alternate locations such as China

North America is one of the top R&D spenders in the semiconductor vertical ; though India R&D centers are mature, the competition from other APAC locations is also rising rapidly

Large companies from Japan and APAC dominate R&D spending in consumer electronics; most India centers are currently operating at low intensity

North America and Europe dominate R&D spending in Telecom; some of the R&D centers in India in this vertical have become global R&D hubs in just a short period of time

North America and Europe dominate the Aerospace and Defense vertical; most India centers were started in the last few years and more are expected to enter this space soon

Japan and Europe dominate R&D spending in automotive vertical; most of the R&D centers in India in this vertical have also started recently and are well positioned for growth

CHINA DOMINATES: The top global R&D spenders across various verticals are making large investments in China. One of the largest software companies in the world is planning to invest USD 500 million in 2010 as a part of the major R&D push in China. The company is also planning to make Beijing, the R&D headquarter for Asia. GE is planning to invest over USD 500 million in six innovation centers in China as a part of over 2 billion dollars planned investment in R&D and JV’s in China. Recently, Qualcomm opened an R&D center in Shanghai. It is also planning to setup the same in Taiwan. Recently, STMicroelectronics and Tsinghua University in China have announced long term strategic R&D Partnership. GM shifted its advanced R&D center to China. Over the next 5 years, Volkswagen plans to invest USD 70 billion in joint ventures in China

Where India lags: India is lagging behind China on several parameters which decide the attractiveness of a country as an offshored R&D services destination

India lags behind in terms of all infrastructure parameters like power, telecom, and testing & prototyping.

On macroeconomic parameters, India lags far behind the East European countries, which are ranked highest on most macroeconomic parameters.

In addition to the basic policy frameworks, specific policies targeted toward easier import of electronics components need to be put into place.

India’s pool of scientists and engineers is abundant, but must be improved quality-wise as compared to talent in Israel and South Korea.

India lags behind in terms of adequate components and supply chain ecosystem, hindering the growth of electronics manufacturing industry.

Feb 7 2011