Mobile Phone Users in India and their Mobile Usage Behavior and Preferences

We bring you extended extracts from the annual study of the Indian Mobile usage by Juxt Marketing. Their numbers are in many areas, lower than those of the official Indian monitor, the Telecom Regulatory Authority, whose stats we use ( among others) to provide you the Snapshot feature on this page. In the interests of academic rigour, we also include , Juxt's analysis of why their results are at variance with TRAI.

Methodology and comparability with official Indian data A large-scale land survey was conducted to profile and estimate the Indian mobile users. The survey covered ‘towns’ and ‘villages’ of all population strata in all the mainland states and union territories in India (covering all the key, and 69 of the total 77 regions in India as classified by NSSO) – all 23 telecom circles were covered extensively. To estimate the mobile user-ship correctly and to make the findings representative of all mobile users in India (and not just of those surveyed), telecom circle-wise, urban district/village class and SEC combination level ‘representation weights’ as derived from authentic ‘Govt. of India’ base-level population statistics (NSSO/Census) were applied to the survey data

There is limited comparability between Juxt India Mobile Study data and Telecom Regulatory Authority of India (TRAI) data, and for the following reasons:

Juxt data is based on ‘primary’ consumer survey while TRAI data is ‘secondary’ in source

While Juxt survey measures and reports both the mobile users (subscribers) and mobile connections (subscriptions), TRAI data reports only the mobile connections (which it mistakenly calls ‘subscribers’). In Juxt data there is a direct linkage between ‘number of active subscribers’, ‘number of active subscriptions’ and ‘number of active SIMs per subscriber’. Unless the same linkages are available as clearly and as comprehensively in TRAI data, a direct comparison is neither advisable nor appropriate

Juxt measures only those mobile connections (SIMs) which are ‘actively’ in use at the time of the survey, not counting the ‘passive’ SIMs that may still be lying with subscribers ‘un-surrendered’ but not being used actively. TRAI reports all ‘un-surrendered’ mobile connections (SIMs) in circulation as reported by the mobile operators, which may be ‘actively’ in use or lying ‘passive’ (in use sporadically, rarely or not in use at all)

BIG Picture

If the story of internet usage in India revolves around ‘lack’ of growth and spread, the story of mobile usage in India on the contrary revolves around ‘surfeit’ of growth and spread. If all mobile subscription numbers have crossed 600 million mark as per TRAI’s latest figures, then it has shown a growth of almost 50% in last one year (from around 400 million mark in May 2009 as per TRAI figures)

However, as this study suggests, if there are only around 355 million mobile connections being ‘actively’ used in the country, then there are a good 40% of all mobile connections which are not getting captured as ‘actively’ in use. Even if one were to give and take a few million connections from the two figures, the question of at least ‘1 in 3’ mobile connection not in active use stares us point blank

Is it a case of ‘over buying’ on part of the consumers? Or of ‘over selling’ on part of the mobile industry? Or a combination of both leading to an artificial ‘spiraling and churn’ of new connections between various service providers - a case of ‘too many connections from too many operators chasing too few customers in too short a time period’ in a very high stake game?

These are critical questions which need to be asked and answered by all who are seriously involved in the mobile business, including the regulators. Though this study does not throw light on answers to these questions, nor was it meant to do so, we are confident that it does throw up light, and bring more clarity on the profile, lifestyle and mobile usage behavior of ‘active’ mobile users from various parts of the country

While the ‘household level’ penetration of mobile phones and connections has reached a vey high (in Indian consumption context) 61% overall, and 88% among the urban households, the fact that only 26% of all Indians are active users of mobile phones still leaves a lot of scope for ‘sensible’ growth and spread of mobile phone usage in India

The huge gap between ‘penetration levels’ of mobile phones at household and individual levels is a result of the fact that almost 2/3rd of mobile using households are still ‘single mobile user’ households. There is still a large ‘play area’ available to increase the user base and ‘penetration’ of mobile phones than to play mainly the game of ‘multiple connections’ and increasing mainly the ‘tele-density’. For this to happen, the spotlight must shift and focus on the ‘user’, and not on the ‘connection’

Another big issue the study throws light on is the ‘split’ of mobile phone usage between urban and rural India. While the TRAI data indicates a 75:25 split at the overall mobile connections level, the split at both the subscriber level and the ‘active’ connection level as found in this study comes closer to a 50:50. Anyway, given that Indian population split itself is 70% rural and 30% urban, any split of marketing a ‘mass’ product like mobile phone (which it is with the pivot of its usage centered among the ‘middle’ and ‘lower middle’ class), that is heavily loaded in favor of urban India is bound to drift towards the hinterlands eventually

And the Indian hinterland has already lapped up the mobile phone to a decent extent. Seen from an all India perspective, SEC ‘R2’ forms the biggest chunk of active mobile users in the country. Further, ‘B’ circles which accounts for a good proportion of rural population, already contributes the ‘biggest chunk’ of mobile subscribers as well as subscriptions among the various circle types

What is even more interesting, and contrary to the poplar perception, more than half of all ‘multiple active connections mobile users’ (MCMU) come from the rural areas. That is, ‘active’ usage of ‘multiple SIMs’ is already as prevalent in the rural areas as in the urban areas. And it appears that the urban and rural mobile users show very similar ‘propensity’ of using multiple mobile connections ‘actively’, the urban areas show only a higher propensity to have more ‘mobile users’ in the household

However, what is also important to understand about ‘rural’ usage of mobile phones in India is that the majority of the rural mobile users and connections originate in the ‘larger’ population size villages (>2,000 population ones), which also show a high propensity to have ‘multiple SIMs’. Further, 3/4th of all existing rural mobile subscribers stay ‘within 10 kms ‘distance from the nearest town – indicating a fairly concentrated penetration of mobile users in the rural areas

Broadly, the ‘more populous’ states seem to account for more mobile subscribers, clearly establishing the ‘mass’ nature of mobile as a product. The fact that after SEC ‘R2’, it is SEC ‘C’ and ‘B’ that contribute the next biggest chunk of mobile users makes mobiles a truly ‘middle’ class product in the Indian context

Reflecting this ‘mass acceptance’ of mobile phones is also the fact that almost half of all active mobile handsets in use are claimed to have been bought in the price range of `1,500 – 3,000. Further, ‘unskilled and skilled workers’ form the largest ‘occupational’ chunk of mobile users in both urban and rural India

Even in the urban areas, ‘housewives’ and ‘students’ form the ‘second’ and ‘third’ biggest chunk of mobile users (both segments counting for more mobile users than all the corporate employees, self-employed professionals and business owners put together). With over half of all mobile users coming from `6,250-40,000 MHI groups, the ‘critical mass’ of Indian mobile usage revolves around the ‘middle’ and ‘lower middle’ income groups

The ‘typical’ caricature of the Indian mobile users (if there is one at all) is largely of someone who has had education only up to school and has been educated either completely or for a large part in ‘vernacular’ languages (as only 1 in 25 urban and 1 in 100 rural mobile users have had their complete education in ‘English’)

In their consumption lifestyle orientation, the Indian mobile users are largely ‘budget’ buyers and ‘need driven’ up-graders at their core. Only about 1 in 5 of them are ‘lifestyle up-graders’ by inclination. Most of them give highest priority to ‘price’ while making buying choices, but followed thereafter by ‘brand image’ (probably indicating a buying logic that if the desired brand comes in the desired price they’ll take it, if not then they may sacrifice the desired brand but not the desired price). Functionality attributes (quality, usage, looks, features, etc) appear as their ‘next’ set of priorities

They perceive, and use their mobile handset as much as an ‘entertainment device’ as a ‘communication device’. Accordingly, ‘games’, ‘music’ and ‘camera’ are the most present features on their ‘most used’ handsets. Most interestingly, their mobile handsets have also become their main device for listening to ‘music on the go’ for most of them

However, their mobile phone has not become a device for ‘going online’ for most of them. Though a good 16% of them user internet per se, only 4% access internet on their mobile phones directly. Even within this 4%, most of them are ‘dual device’ internet users (accessing internet on both mobile and PC), clearly indicating that mobiles are only ‘complementing’ PC based internet access as of now and not really being seen as a ‘alternative’ mode of accessing internet. The limited presence of ‘bluetooth’, ‘extended memory’, ‘GPRS’ and ‘internet related applications’ on their mobile handsets also reinforces this hypothesis to some extent

FINDINGS

There are 304 million mobile subscribers in India, using 355 million connections ‘actively’

Avg mobile users per household is 2.05 and avg ‘active’ mobile connections per user is 1.17

Household level penetration of mobile phones is 61% , individual level penetration is 26%. Tele-density at all India level stands at 31%, with urban tele-density way ahead at 54%

Rural India accounts for almost as many ‘active’ mobile subscribers and subscriptions as urban India – rural users show the same propensity to take up ‘multiple SIMs’ as urban users, but lower propensity to have ‘multiple mobile users’ in the household

2 out of 3 mobile using households are still ‘single mobile user households’

4 out of 5 mobile users are ‘single active mobile connection users’. The user base of active ‘multiple mobile connection users’ is around 59 million

‘Mumbai’ circle tops among urban areas with 10.4% urban mobile subscribers, Bihar tops among the rural areas with 11.8% rural mobile subscribers

‘B’ circles account for the largest chunk of mobile subscribers as well as subscriptions, more so in the rural areas

Active use of ‘multiple SIMs’ is most prominent in ‘A’ circles (and has a ‘mass’ base rather than an ‘elite’ one)

Gujarat users, apart from MP, Maharashtra and Karnataka ones, show higher propensity to ‘use’ active multiple SIMs

3/4th of all rural mobile subscribers stay ‘within 10 kms ‘distance from the nearest town – indicating a fairly concentrated penetration of mobile users in the rural areas

On an average Indian mobile users claim to talk 23 minutes daily. Rural users are only marginally ‘lighter’ talkers

They claim to spend on an ‘average’ `240 monthly on their most used connection. Rural users claim to spend about 20% less than the urban users

‘Outgoing STD’, ‘call waiting’ and ‘domestic roaming’ are the most subscribed services by both urban and rural users

2/3rd mobile users claim they ‘will not switch’ operators even if the number becomes ‘portable’

Only 1 in 25 mobile users (11.6 million) surf internet on their mobile phones currently. 9 out of 10 of them are ‘dual device users’ (accessing internet on both mobile and PC)

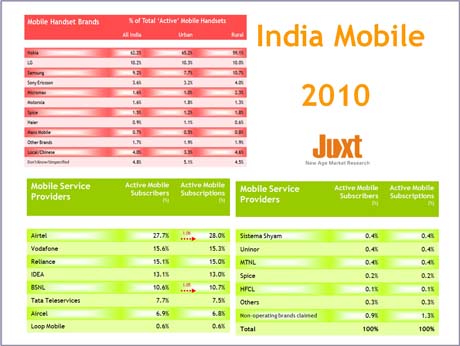

Airtel is the biggest operator overall with 27.7% share of all ‘active’ subscribers base, and 28.0% share of all ‘active’ subscriptions. Vodafone follows next, with Reliance being a close 3rd

Airtel also has the highest ‘subscription-subscriber ratio’ and shows the highest ‘propensity’ to be a user’s next ‘active’ multiple mobile connection. BSNL follows thereafter

Among only GSM players Airtel stays at the top with 34.4% and 34.8% share respectively

Among only CDMA players Reliance Comm tops with 55.9% and 56.0% share respectively. It is followed by Tata Teleservices and Tata DoCoMo

On ‘most used’ connection basis, Airtel tops. Reliance comes up as the joint 2nd with Vodafone. Operators who’s share fall somewhat at ‘most used’ connection level are Idea, Uninor and Spice

HANDSET USAGE

There are 0.48 million more mobile handsets than the 355 million ‘active’ mobile connections

‘Single’ active mobile handset users predominate in both urban and rural areas at 85%

Half of all mobile handsets ‘in use’ are claimed to have been bought in Rs 1,500 – 3,000 price range

Compared to rural users, urban users show a lower relative incidence of buying a handset below Rs 1,500 and a higher relative incidence of buying one costing over Rs 3,000.

Mobile handsets are as much ‘entertainment device’ as ‘communication device’ for most mobile users. Mobile handsets have also become the main device for listening to ‘music on the go’ for most of them, but a device for ‘going online’ for only a very few of them as yet

HANDSET BRANDS

Almost 2/3rd of all ‘active’ handsets are Nokia (on both ‘multiple usage’ basis as well as ‘most used’ basis). LG follows as a distant second at 10%

Samsung, Sony Ericsson and Micromax make up the rest of the top 5 list

Nokia appears to be used more in ‘urban’ areas than in rural areas, while Samsung, Micromax and Spice appear to be used relatively more in the rural areas than in the urban areas

Maxx Mobile shows the highest ‘propensity’ to be a mobile user’s next ‘multiple handset’. Among bigger players, Samsung shows the highest propensity, followed by LG and then Nokia

DEMOGRAPHICS

The ‘25-35 years’ forms the ‘single’ largest age group among mobile users, though usage of mobile phone per se cuts across all age groups in both urban and rural areas

‘Housewives’ form the second biggest occupational group of mobile users in the urban areas (more than all the corporate/self employees/business owners put together). Interestingly, usage among ‘children’ in urban areas is almost as high as among ‘teenagers’

2/3rd of all mobile users are educated only up to school. And 2/3rd are educated completely in ‘vernacular’ languages (only 4% urban and 1% rural mobile users have had their complete education in ‘English’)

For all India, SEC ‘R2’ forms the biggest chunk of active mobile users, followed by SEC ‘C’ and ‘B’ (makes mobile phones a truly ‘middle’ class product in India)

The ‘critical mass’ of Indian mobile usage revolves around the ‘middle’ and ‘lower middle’ income groups (58% of all mobile users come from the `6,250-40,000 MHI groups)

PSYCHOGRAPHIC PROFILE

The ‘25-35 years’ forms the ‘single’ largest age group among mobile users, though usage of mobile phone per se cuts across all age groups in both urban and rural areas

‘Housewives’ form the second biggest occupational group of mobile users in the urban areas (more than all the corporate/self employees/business owners put together). Interestingly, usage among ‘children’ in urban areas is almost as high as among ‘teenagers’

2/3rd of all mobile users are educated only up to school. And 2/3rd are educated completely in ‘vernacular’ languages (only 4% urban and 1% rural mobile users have had their complete education in ‘English’)

For all India, SEC ‘R2’ forms the biggest chunk of active mobile users, followed by SEC ‘C’ and ‘B’ (makes mobile phones a truly ‘middle’ class product in India)

The ‘critical mass’ of Indian mobile usage revolves around the ‘middle’ and ‘lower middle’ income groups (58% of all mobile users come from the `6,250-40,000 MHI groups)

The ‘critical mass’ of Indian mobile usage revolves around the ‘middle’ and ‘lower middle’ income groups (58% of all mobile users come from the `6,250-40,000 MHI groups)

‘Cinema’ and ‘listening to music’ are their biggest hobbies

Interestingly, 5 out of the top 10 ‘most identified celebrities’ among mobile users are politicians

‘Watching TV’ is their biggest indoor entertainment, followed by watching ‘movie CDs’. ‘Chatting on phone’ is only a marginal indoor activity

Among popular outdoor activities, ‘watching movies in cinema hall’ is relatively more popular in urban areas, and ‘visiting neighbors’ in the rural areas

CONSUMPTION Most of them are ‘need driven’ up-graders at their core (only 1 in 5 are ‘lifestyle up-graders’ by inclination)

4 out of 5 mobile users are essentially ‘budget’ buyers. However, while 2 out of 3 give high importance to ‘price’, almost a similar number also gives high importance to ‘brand image’

Over half of them have ‘never responded’ to any ‘response triggering’ marketing stimulus (seems they do not make a very good ‘direct marketing audience’ per se)

Only a minuscule 5% ‘urban’ mobile users drive a car, only a little over 1% have a credit card individually, and only 1 in 12 takes holidays/vacations (essentially domestic holidays/vacations)

Mobile users watch ‘TV’ the most among all media, though half of them also read ‘newspapers’. However, the mobile users who use ‘internet’ use it the most ‘heavily’ of all mediums

Source: www.juxtconsult.com

Aug 15 2010