The seemingly insatiable demand by users for more data has taken many players in the telecom and communications sector by surprise. To keep up with demand, new infrastructure is often needed and particularly data centres – the heart and brain of any network. When speed is the key, prefabricated and modular data centres that can be deployed in mere days have become popular -- even critical. Indeed for India this has useful lessons for rapid network creation after natural disaster situations.

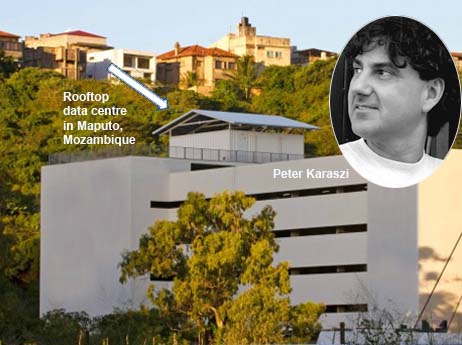

Telecom expert Peter Karaszi explains how the challenge can be addressed -- with some interesting examples from Africa.

Global mobile data traffic grew 81 percent in 2013, according to a recent report by Cisco (Global Mobile Data Traffic Forecast Update). Last year’s mobile data traffic was nearly 18 times the size of the entire global Internet in 2000. Smartphones and tablets are driving this traffic explosion. A typical smartphone generates 48 times more mobile data traffic than a basic-feature cell phone.

And it is not slowing down anytime soon: global mobile data traffic is expected to increase nearly 11-fold between 2013 and 2018, growing at a compound annual growth rate of 61 per cent. By 2019, the number of smartphone subscriptions is expected to reach 5.6 billion, according to Ericsson.

So where does this leave mobile operators, scrambling to benefit from this data boom?

To cope with the increasing traffic, telecom infrastructure is key. And that often means investing in new infrastructure, and better infrastructure. There are many ways to improve efficiency in every part of the network, from smarter Operations Support System (OSS) solutions to ultra-high efficiency antennas.

Let us take a look at maybe the most important link in the chain: the data centre. High quality, efficient data centres are essential. They house and power all the equipment needed for transmission of data and are both the heart and brain of any network.

Telecoms operators and other IT players often have long lists of reasons for planning for a new data centre, but the increasing data demand by customers is the most common reason. They have quite simply run out of space in their existing facilities and urgently need to expand to meet current demand (and let alone future demand). Lack of capacity is no option. It would be like telling all existing and future customers to get lost and rather turn to a competitor. It would seriously hurt the brand and the bottom line.

Data and switching equipment is relatively easy and quick to order. The data centre building itself is trickier. In many markets, it can take over a year to plan, co-ordinate (with different suppliers) and construct a new data centre facility. There are often delays and budget over-runs. Buildings for data centres are often not purpose built to be used as technical facilities and often have water leaks and other problems.

So mobile operators, hosted data providers, internet service providers and others are increasingly choosing turnkey prefabricated data centres instead of brick and mortar solutions. They are much quicker to deploy, which saves time and money, and will always be the “right” size since their modular structure make them easy to quickly expand in response to changing needs.

Roof top data centre installation in just eight days: Vodacom Mozambique’s deployment of a prefabricated data centre (Flexenclosure’s eCentre) on top of a six-storey building in central Maputo is one excellent example of the need for speed when installing a new data centre. The 126 square meter data centre building was manufactured in Sweden, shipped to Maputo and installed in just eight days! (See the IndiaTechOnline report )

Benefits to the client were a guaranteed product (versus an uncertain project), a guaranteed budget and guaranteed delivery on time. This would have been very difficult, if not impossible, to achieve with a traditional brick and mortar structure.

A second reason for mobile operators needing a new data centre speedily is when there has been a data centre-related incident of some kind, which needs a very quick fix. In August 2013, a battery-related fire damaged Vodacom Tanzania’s energy centre in Dar es-Salaam, resulting in a serious (and very public) disruption to its network services. This time the eCentre was chosen to replace the old energy centre. It included separated A and B sides and separated batteries, increasing redundancy and security and thus minimising the risk of any impact on business continuity in case of another accident.

Prefabricated data centres are not constructed on site but rather in a clean environment far away from the deployment location. All engineering expertise is already there and the systems can be thoroughly tested before shipment.

Energy efficiency is also becoming more important, especially in emerging markets where energy supplies are generally unreliable and the cost of power is constantly rising. A modern prefabricated modular data centre uses the most appropriate and efficient cooling solutions available. For example, indirect free air cooling can provide up to 70 percent electricity savings. A smart infrastructure management system can monitor energy efficiency remotely and optimise power usage. In all, this leads to significant reductions in energy consumption and cost.

In conclusion, experience on the ground has given the industry strong incentives to choose turnkey modular data centres over traditional builds. In the long run, this is very good news for both end consumers and suppliers of sought-after data to keep the smartphones ticking and beeping. The very strong trend in favour of custom-designed prefabricated data centres is set to continue.

June 22 2014

Peter Karaszi is a communications expert in intelligent telecom solutions based in Cape Town, South Africa. He has over 30 years of experience from the telecom and IT industry, including positions with boards of global technology corporations. He has written six books and numerous articles.