By Anand Parthasarathy

May 12, 2023: In February this year, the Singapore-headquartered global technology analyst, Canalys, released the latest edition of its annual Automotive Analysis and it included a significant finding: Though Electric Vehicles or EVs initially accounted for just 1.3 of the overall Indian light vehicle market, it has been growing at a phenomenal 223% during 2022 and has added 48,000 EVs since then.

Canalys forecast that the India EV market will grow to some 300,000 vehicles in 2025, making for 6% of the total light car sales -- an almost five-fold increase in the market share for electric vehicles.

The growth of EVs is driven to a good extent by the Indian government’s incentives under the “Faster Adoption and Manufacturing of Electric and Hybrid Vehicles in India” or FAME scheme, whose second phase now stands extended till March 2024. But the monetary benefits to EV makers is incumbent on their sourcing key components and ancillaries from Indian manufacturing, rather than importing them

This has presented a rare opportunity for indigenous automotive component manufacturers, many of whom have nimbly expanded their range to embrace the special needs of battery-driven vehicles—2,3,4 wheeled as well as larger multi-axle freight carriers.

High-tech meets Mobility

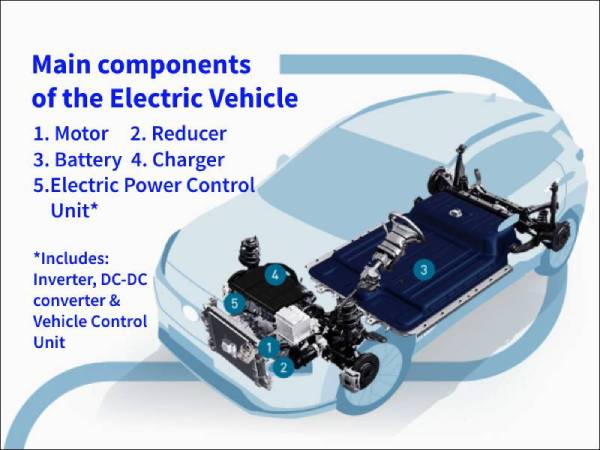

This is a new arena where high-tech meets mobility, so hundreds of startups have jumped into the manufacturing maidan joining established auto ancillary industry players, to innovate in new and emerging technology areas that like Advanced Driver Assistance Systems (ADAS), Car Telematics, Body Control Units (BCUs), electric drives and powertrains, Electrical Control Units (ECUs), Vehicle Control Unit (VCU), inverters and battery charging systems.

The business is not limited to Indian companies : One year ago, in May 2022, a Frost and Sullivan report concluded: “Automakers now look to India as an exciting market for component manufacturing”. It pointed to the “conducive environment” driven by friendly government policy and cited this as proof

“The world’s largest automaker, Toyota, (has) announced investment plans of around $624 million to localize component production, including electric drives and electric powertrain parts, for battery EVs (BEVs), plug-in hybrid EVs (PHEVs), and other hybrid EVs (HEVs). The bulk of the investments will be shouldered by Toyota Kirloskar Motors and Toyota Kirloskar Auto Parts, with Toyota Industries Engine India also chipping in”

F&S also predicted a trend: “We believe that localization – whether of all components or target/mode-specific – will be the way forward for EVs in India…We will see most automakers developing their electric motor technology in-house. Foreign automakers will focus on partnering with local component manufacturers either as part of joint ventures or as technology partners.

Exactly one year later, that report seems startlingly prescient – and no better proof was needed than the technology on display at the annual (Connected, Autonomous and Electric Vehicle) ‘CAEV 2023’ expo organized in Bengaluru last month by Telematics Wire, with support from the Union Ministry of Electronics and Information Technology and the Ministry for Micro, Small and Medium Industry|

The control system of an electric vehicle has become a complex software platform, so it was no surprise to find Indian software and services bellwether Infosys displaying its own solutions for an EV partner – Maini -- makers of India’s first electric car, Reva. On show were two Maini battery-powered vehicles, a 4-wheeler, TT50, with optional driver controls and an Autonomous Mobile Robot (AMR10) whose auto features include 360-degree perception, low lying obstacle detection, auto charging and fleet management.

Car telematics, Made in Go

The Michigan (US)-based Danlaw Technologies, one of the world’s largest suppliers of connected devices, displayed its range of vehicle telematics products, now manufactured at its Indian plant in Salcette, Goa, with R&D being carried out in Bengaluru. These include Body Control Units which manage functions like vehicle lighting, wiper control, climate control, central locking etc; Telematic Control Units (TCU) which control navigation using GPS as well as the Indian NavIC (RNSS) system, wireless tracking, self-diagnosis and Cloud support

A Danlaw subsidiary, the UK-based Rapita Systems, provides software tools to test and verify vehicle electronic systems and feed the Telematics Control Unit – and its Indian users include Ashok Leyland and Royal Enfield

According to the latest edition of the Cyber Media Research (CMR) Auto Market Report Review, released on May 9, the electric two wheeler (E2W) sector which accounts for the largest selling class of EVs grew at 44% year on year, during the first three months of this year. The “Connected 2-Wheeler” (C2W) vehicles, conventional scooters with Internet-based tools, grew from around 92% Year-on-Year, with its market share increasing to nearly 60% during the same period

Serving these 2-wheelers, mostly scooters, are players like Bolt, better known in metros for their EV battery charging stations to be found in many apartment complexes and homes. The Bolt OS or operating system which was showcased at the CAEV show, powering the Okinawa and Batt.RE scooters, works under the dashboard of many popular e-two wheelers, monitoring and managing battery health, music controls, vehicle diagnostics, keyless vehicle control, navigation assist, anti-theft features, geo-fencing etc.

Battery Charging, a crucial component of EVs

Battery charging stations have become the ‘most wanted’ elements of the EV ecosystem. Unless the national network of public charging facilities grows very fast, potential buyers of electric cars and bikes will be skeptical about taking the leap.

The Thiruvananthapuram (Kerala) centre of the government-run Centre for Development of Advanced Computing (C-DAC) has developed a range of battery charging units, from a single phase 3.3 KW system for small manned as well as unmanned stations to a 3-phase, 15 KW dual point EV charger, suitable for petrol/diesel dispensing bunks and the large EV fleet owners. In keeping with its mandate C-DAC has transferred its technology to private parties for quantity manufacture.

From Education to EVs

The opportunity presented by EV development in India, has attracted some unconventional players. The Chennai-headquartered Edutech is better known for its skilling and vocational services. At CAEV, its PIX division showed its offerings for EV integrators and Original Equipment Manufacturers (OEMs), lowering the entry barrier for startups desirous of developing smart vehicles. PixKit, is an autonomous driving development kit, which covers all important subsystems like navigation, industrial computer, monitor, camera, Light Detection and Ranging (LIDAR) and Bluetooth. It promises that developers can create a rapid vehicle prototype in just 30 days.

Testing and measurement is a key component of EV development and Bengaluru-based MaxEye Technologies offers a range of automated testing equipment for e-vehicular, telematics, in-vehicle infotainment, connected car tests and advanced driver assistance systems (ADAS) tests, as well as simulators to check out NavIC, GPS, Galileo, Glonass and other international navigation systems.

One of the largest stands at CAEV this year was occupied by Teltonika, a leading European mobility player headquartered in Lithuania and it was indicative of the attraction of the burgeoning Indian EV market for global providers. The company displayed solutions for a growing segment of the two-wheeler EV sector in India – app-based electric scooters available in major cities for hire, heavily patronized by gig workers for last mile delivery business like Swiggy, Zomato, Porter and Dunzo. Teltonika showcased compact units to track, lock-unlock and generally manage such vehicle-based smart services.

Bosch, the leader in mobility solutions and one of the earliest international companies to set up manufacturing in India, has moved with the times with its key offerings to address the new EV market with a suite of solutions for device management, intelligent logistics and fleet control, location and mapping. It is seemingly seeking its own niche in the large fleet end of the electric vehicle business.

According to Counterpoint’s “India Electric Vehicle Forecast Analysis” November 2022, the overall EV penetration in India is expected to cross 66% by 2030. For the ancillaries and components sector, the good news in the report is: “With the rise in the number of EVs, we will see an increase in demand for telematics”.

Be it a large fleet or individual bike, private car owner or 3-wheeled local delivery van, driven or autonomous, the business of serving one of the fastest growing sectors of India’s transportation sector is suddenly looking like an exciting, challenging opportunity.

For illustrations of products described see our Image of the Day feature