August 2 2022: India’s auction of its airwaves ended yesterday after seven days, with 51.2 GHz of spectrum out of 72 GHz on offer sold ( about 71%), for Rs 1,50,173 crore. (1.5 lakh crore or 1.5 trillion or $ 19 billion).

The auction was held for spectrum in various low (600 MHz, 700 MHz, 800 MHz, 900 MHz, 1800 MHz, 2100 MHz, 2300 MHz, 2500 MHz), mid (3300 MHz) and high (26 GHz) frequency bands.

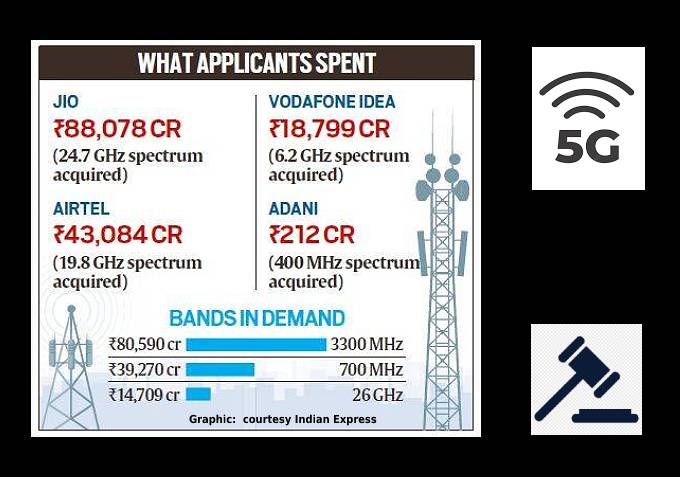

Reliance Jio was the biggest buyer in the 5G spectrum auction, and was the only one to acquire spectrum in the premium 700 MHz band. Reliance Jio spent Rs 88,078 crore and acquired a total of 24.7 GHz of spectrum in the 700 MHz, 800 MHz, 1800 MHz, 3300 MHz and 26 GHz bands.

The biggest service provider today, Bharti Airtel, acquired a total of 19.8 GHz of spectrum in the 900 MHz, 1800 MHz, 2100 MHz, 3300 MHz and 26 GHz bands, paying Rs 43,084 crore.

Vodafone Idea bid for the 1800 MHz, 2100 MHz, 2500 MHz, 3300 MHz and 26 GHz bands, acquiring a total of 6,228 MHz of airwaves, paying Rs 18,799 .

Newcomer Adani Data Networks acquired spectrum in the 26 GHz band for Rs 212 crore, and its stated aim was to provide solutions to business, not individual consumers.

Comments Kantipudi Pradeepthi, Telecom Research Analyst at GlobalData:

5G spectrum is crucial for Indian telcos to power their revenue growth by offering ultra-high speed wireless network services

Despite the unfounded concerns around radiation levels or worries around higher prices, the next generation of mobile broadband is set to drive mobile data usage in India by 29% and data revenue by 67% between 2020 and 2026, forecasts GlobalData.

Not surprisingly, the 5G spectrum auction has attracted the participation of not only prominent operators like Reliance Jio, Bharti Airtel, and Vodafone Idea, but also billionaire Gautam Adani’s Adani Group, which is set to foray into the telecom services market through its subsidiary, Adani Data Networks.

The encouraging results from the 5G spectrum auction shows that the Indian telecom sector has not just been able to overcome the challenges that it faced over the last few years but is ready for the expansion and 5G service rollout, which it aims to achieve by the end of this year. This sits perfectly with GlobalData’s mobile services forecast, which indicates that the 5G service subscriptions in the country are projected to reach 464 million by 2027.

5G technology is expected to create more job opportunities and usher in the next phase of economic growth in India by enabling solutions such as connected vehicles, more-immersive augmented reality and metaverse experiences, and Cloud services. 5G can empower the organizations to build private networks. The technology will also allow manufactures to embark on the Industry 4.0 journey, and empower the smart city projects underway in the country. This should encourage digital businesses including edtech, healthtech, agritech, fintech, and e-commerce to further accelerate 5G adoption in India.

A commentary in Hindu Businessline yesterday reads:

Out of the 72 GHz of spectrum put on the block, only 51 GHz has been sold, leaving about 30 per cent of the spectrum unsold. The total realised value is about ₹1.5 lakh crore compared to the expected value (at reserve price) of ₹4.3 lakh crore. So, who is the winner? Is it the government — the auctioneer — or the telcos — the bidders? Unfortunately, it is neither.As expected, there has been some action in the 5G bands, namely, 3.3 GHz and 26 GHz bands. In 3.3 GHz, a total of 5,490 MHz has been picked up by the bidders out of a total 7,260 MHz at reserve prices across various Licensed Service Areas (LSAs).

All in all, it has been a disappointing auction, mainly due to the huge amount of spectrum going unsold. Spectrum is a precious natural resource and should be put into effective use and cannot be wasted.