July 23, 2022: iPiD is a Singapore-headquartered, venture-backed fintech start-up with an India presence that has a vision to simplify cross-border payments to be as easy as a text message.

Asit Oberoi, iPiD's regional head for South Asia and India, explained how it works:

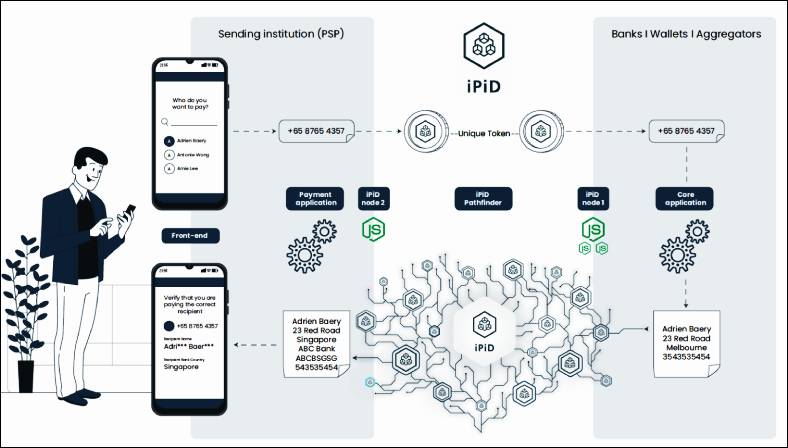

iPiD brings together a global data-sharing community for payment addressing data. iPiD orchestrates API calls based on tokens to validate and fetch payment details based on a proxy (e.g. phone number). Customers of financial institutions partnering with iPiD only need to provide the recipient’ phone number to send outward remittances. Receivers do not need any longer to provide their banking details to senders if they are a customer of financial institutions partnering with iPiD for inwards remittances.

iPiD works with banks, payment fintechs and payment systems. We help them to provide a better customer experience to their clients, to reduce failed payments due to data errors, and to improve the sense of security when doing cross-border payments thanks to the payee verification functionality. Both retail and corporate end-users benefit from this new experience.

iPiD is not a payment provider; we do not process payments. Rather, we orchestrate payment data between financial institutions. In that sense, there is no requirement for regulatory approval.

What are the charges levied on customers? How does it compare with international bank transfers or forex commissions charged by moneychangers or credit cards? iPiD is a new feature, not a new payment product. We do not expect that our customers will charge additional fees for this feature to their clients.

What are the various types of payments that can be made through iPiD -- remittances, hotel or travel expenses, shopping? At first, we iPiDs expect the service to be used mostly for remittances and invoice-based (asynchronous) cross border payments.

iPiD will announce this month, the first partners who have joined the ecosystem. Customers interact with the iPiD feature through a bank or payment fintech.

What are the checks and balances to prevent frauds or misuse of account details? ,Many controls are in place to prevent data phishing. Account details are never revealed to end users; they are purely used for processing purpose in the back-office. The name of the recipients is partially masked when it is exposed to senders. A denial of service automatically kicks in when an end-user triggers an abnormal number of requests.

Which are the countries and currencies in which the payments can be made?There is no limitation in terms of currencies since iPiD does not process payments. iPiD will be gradually growing its coverage in terms of reachable countries.