September 5 2021: The Paytm Payment Gateway is the largest in India based on total transactions for the fiscal year ended March 31, 2021, according to Redseer, one of the largest management consulting companies in India.

The company had launched a payment gateway service in 2012 by processing Paytm Payment Instruments, such as Paytm Wallet. By leveraging the large merchant penetration of Paytm Payment Instruments, it has expanded into processing other third-party instruments such as credit card, debit card, net banking, and UPI.

In fact, the payment gateway service is one of its top offerings to merchants to bring them on board its ecosystem. “Similarly, for merchants, certain payments offerings, such as QR (for in-store) and Payment Gateway (for online) are our primary means to on-board new merchants,” the company said in its DRHP*.

The company in its DRHP further stated that its payment gateway empowers a large number of businesses including small businesses, start-ups, small e-commerce firms, and retailers across the country. “We have partnered with 15 major banks in India to enable merchants to provide cashback offers and no-cost EMI-deals,” read the DRHP.

Paytm has been able to establish this service through its advanced technological offerings. “Our advanced features such as management of payment subscriptions, instant refunds on the payment gateway, payment links which the merchants can share with the consumers, and allowing international collections – allowed us to deepen our merchant engagement. With instant on-boarding and reseller on-boarding we have now expanded our payment gateway service to small and mid-sized merchants. We have also launched attachment subscription services such as Super Router, which helps merchants route payment transactional traffic between multiple payment aggregators,” said the company in its DRHP.

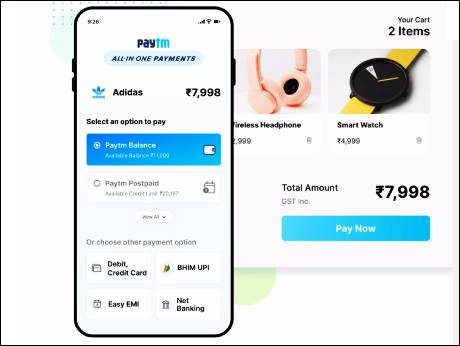

Additionally, the company had also launched Paytm All-In-One Payment Gateway, which can be integrated into desktop, websites, or mobile apps in a store. By integrating the service, merchants can start accepting online payments and expanding the digital reach of their business. It ensures quick integration of the payment solutions, eliminates redirection, and enhances brand visibility with a customized user interface and logo.

*A draft red herring prospectus (DRHP), also known as the offer document, is prepared by the merchant bankers as a preliminary registration document for companies looking to float an IPO