New Delhi August, 13, 2018: Xiaomi remains the leader in the India smartphone market with growing offline presence while maintaining dominance in the online space. Xiaomi contributed more than 56% of the shipments in online space, while 33% of its shipments went through offline channels in 2Q18.

Smartphone companies shipped a total of 33.5 million units to India during the second quarter of 2018 (2Q18), resulting in a healthy 20% year-over-year (YoY) growth.

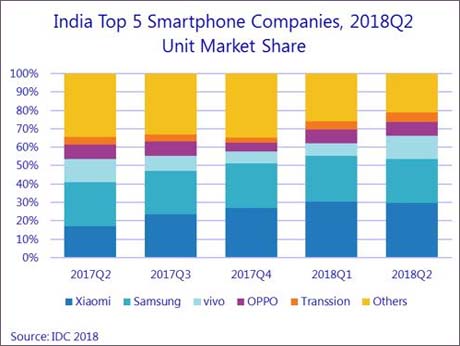

According to IDC India's (International Data Corporation) Associate Research Manager, Client Devices, Upasana Joshi and the company's Quarterly Mobile Phone Tracker, the market, however, is seeing rapid consolidation at the top end, as the top 5 vendors made up 79% of the smartphone market in the second quarter of 2018.

In the online segment, Huawei with strong shipments of its Honor branded phones, climbed to the second position with an all-time high of 8% share in online segment in 2Q18. "Huawei has had a stellar quarter worldwide moving into the second position, toppling Apple. In India, with a refreshed focus it has been able to grow its share in the online space in the last two quarters, on the back of several new launches across price segments. IDC believes Huawei should be seen as a serious long-term player in India market with all the ingredients to challenge Xiaomi and Samsung" adds Joshi.

Other online-focused vendors with online exclusive launches were OnePlus with its new launch OnePlus 6, Realme with Realme1 and Asus with Zenfone Max Pro series, all of which led to an annual growth of 44% in the online channel shipments and taking the online share to 36% of the smartphone market.

Offline segment growth was driven by Vivo which had strong shipments during the quarter on the back of high decibel marketing campaigns around new launches like V9 including advertisement campaign featuring popular movie star Amir Khan, title sponsorship in Indian Premier League cricket tournament and attractive booster schemes available for channel partners.

"The growing popularity of financing schemes in the offline channel across model portfolios by almost all vendors is driving affordability and thus pushing the overall smartphone ASP's to a record high of US$167 in 2Q18 from US$157 in 2Q17.", adds Joshi.

The premium end of the market (US$500+) grew almost two times year-over-year (YoY) mainly due to continued strong shipments of Samsung Galaxy S9 series and OnePlus 6, with OnePlus surpassing Apple to be the second biggest player in the US$500+ segment with a share of 21% in 2Q18.

The feature phone market remained resilient with shipments of 44.0 million units in 2Q18, seeing a growth of 29% over 2Q17. Reliance Jio, the telecom operator and the main driver of the 4G feature phone segment with its JioPhone range of phones, remained the top vendor in the overall feature phone market. However, the 4G feature phone market saw a slight decline of 10% QoQ with 19.0 million units. IDC believes that this drop is due to JioPhone inventory buildup from 1Q18.

Reliance Jio, as an attempt for clearing this inventory, recently introduced the "Monsoon Hungama" feature phone exchange offer and brought popular apps like WhatsApp, YouTube on JioPhone. The 2G feature phone segment continued to decline further as local players struggle for survival in this segment and segment is losing relevance due to the aggressive push in the 4G feature phone segment by Reliance Jio.