New Delhi / Gurgaon, May 6, 2015: The Indian government's lip service to citizen empowerment through connectivity has not translated into action. In fact import duties have effectively slowed down growth of mobile phone buying and for the first time, there is a palpable fall in the handset market to the extent of 15 percent in the first three months of 2015.

This is the key finding of Cyber Media Research's India Monthly Mobile Handsets Market Review, 1Q CY 2015, May 2015, released yesterday.

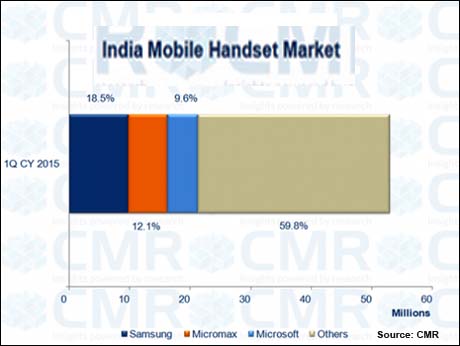

The India mobile handsets market declined 15% in terms of overall shipments over 4Q CY 2014. Of the total 53 million mobile handsets shipped during the quarter, 37% (19.5 mn) were Smartphones. Smartphone shipments also declined quarter-on-quarter,though to a lesser extent -- 7% -- as compared to over 18% in the case of the Featurephones segment.

Says Faisal Kawoosa, Lead Analyst, Telecoms Research at CMR: “With major announcements of new handsets and entry of some new brands happening in a big way in 4Q CY 2014, there wasn’t really something very exciting in the market for customers that could push up sales in 1Q CY 2015. At the same time, change in duty structure and the consequent impact on the supply chain due to the Chinese New Year festivities contributed to the market contraction.”

Samsung has been able to garner a higher market share in featurephones during 1Q CY 2015 as compared to the previous quarter. The company’s share also increased in the Smartphones segment at 27.9%, up from 23.7% in 4Q CY 2014.

Micromax, at second spot, registered a decline to 12.1% in terms overall mobile handset shipments, while in the Smartphones segment its market share was 16.2% as compared to 14% and 17.8% in 4Q CY 2014, respectively. The third player in the market, Microsoft ( mostly the ex-Nokia brands), on the other hand has been able to consolidate its position with 9.6% share in 1Q CY 2015, compared to 10.8% in the previous quarter for the overall mobile handsets market.

Within the Smartphones segment, Intex that emerged at third spot during 4Q CY 2014 continued to strengthen its ranking with a 9.2% market share in 1Q CY 2015, an increase of 1.3%.

Karn Chauhan, Telecoms Analyst at CMR, adds “ e-Retailing works effectively for a brand aiming for 0-5% or 5-10% of the market share and those without a wide portfolio like Xiaomi and OnePlus. But, if you are Micromax, having a double-digit market share of middle to higher order price segment handsets, trying to replicate what Xiaomi and OnePlus are doing isn’t a very good idea.”

“At the same time one has to look at the segment contribution. While Xiaomi, OnePlus and other emerging brands are ‘Smartphone only’ brands, Micromax still gets around half its contribution from Featurephones,” Karn concluded.