Indian hardware industry in 2009-10:

The ( Indian)Manufacturers Association of Information Technology (MAIT) annual IT hardware sector report, suggests better times in the rest of 2010, with notebooks already making a remarkable comeback; desktops doping so-so, servers declining, printers moderate.

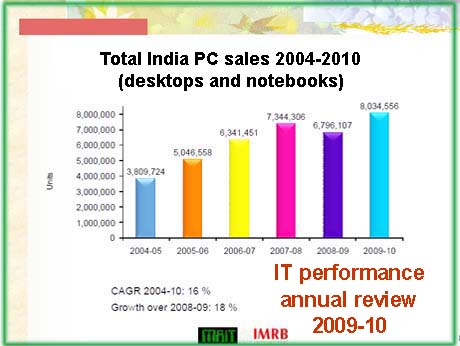

Almost all segments of the IT hardware registered a healthy growth. The industry is hopeful that the overall PC sales for 2010-11 will cross 9.35 million units in FY 2010-11, registering a 16 per cent annual growth.

The total PC sales between April 2009 and March 2010, with desktop computers, notebooks and netbooks taken together, were 8.03 million (80.3 lakh) units, registering a growth of 18 per cent over the last fiscal. The sales of desktops stood at 5.52 million (55.2 lakh) units registering a growth of five per cent. Notebooks and Netbooks taken together recorded a consumption of 2.5 million (25 lakh) units, growing sixty-five per cent over the last year.

The bi-annual MAIT Industry Performance Review – ITOPs, conducted by India’s leading market research firm IMRB International is a survey of the IT hardware sector’s efforts to manage the business environment, gauge the market potential and consumer trends. This round of the study involved face-to-face interviews with over 15,000 respondents selected randomly across 17 cities in India

The Notebook Market:

The Notebook sales, which had suffered badly in the previous year made a phenomenal comeback during the year 2009-10 with a remarkable growth of 65% over the previous year. This growth was primarily driven by the Household segment, which accounted for about 56% of the total Notebook sales and registered a growth of 87% during 2009-10 over the previous year. Netbook sales crossed the 100,000 units for the first time, during the second half of the year 2009-10 (H2 2009-10) The Desktop Market:

Businesses accounted for fifty-eight per cent of the desktop sales with an eight per cent decline in consumption. The decline was on account of very sluggish sales during the first-half of the fiscal. However, Desktop sales among business recovered to some extent during the second half of the year 2009-10 (H2 2009- 10) with a growth of six per cent over the same period last year. Households contribution to the Desktop market increased to forty-two per cent of the total desktop market during 2009-10 from about a 34% during the previous

year. With this, households also registered a growth of 30% during 2009-10 over the previous year.

The Servers Market:

During the year 2009-10, sales of Servers registered a decline of fifteen per cent over the last financial year. This decline was largely on account of the poor sales during the first-half of the fiscal. During the second-half however, the server sales recovered and registered a growth of 14% over the same period last fiscal.

The Peripherals Market:

Overall printer sales grew by six per cent during 2009-10 over the last fiscal to reach 1.72 million (17.2 lakh) units.

Laser printers led the growth with a consumption of 0.52 million (5.2 lakh) units and a growth of 11% over the last year. This growth was driven by the Office and Outlet segment, which together accounted for over eighty per cent of the laser

printer sales and registered a growth of twenty-one per cent & eighty per cent respectively.

Consumption of inkjet printers at 0.81 million (8.1 lakh) units grew by eight per cent. Consumption in the business segment registered a growth of 14% while those in Households registered a growth of one per cent over the previous year.

Dot-matrix printers was the only printer category that registered a decline, the sales of DMP at 0.38 million (3.8 lakh) units in 2009-10 declined by three per cent over the previous year. This decline was largely driven by the household segment which registered a decline of forty-six per cent during this period. The establishment segment managed a two per cent growth.

The UPS market, led by the households, registered a growth of fifty-three per cent in 2009-10 over 2008-09 with 2.32 million (23.2 lakh) units in sales. Households accounted for nearly seventy per cent of the market, whereas the Establishment accounted for the remaining thirty per cent.

Internet Entities: • The number of active Internet entities crossed the ten million mark in March 2010. The overall internet entities increased to 10.06 million (106 lakh) units in March 2010, a growth of seventeen per cent over March 2009.

• Internet penetration in the 17 cities was fifty-three per cent among businesses and twenty-one per cent among households. The business segment now accounts for twenty-six per cent of India’s total active Internet entities and households account for the remaining seventy-four per cent.

• DSL/cable remains the most commonly used means of Internet connectivity among businesses: sixty-two per cent of businesses were found using DSL/cable, ten per cent dial-up connections, eleven per cent ISDN services, nine per cent used leased-lines, five per cent used data cards and another three per cent used VSATs or other type of connections.

The expected Market for 2010-11 Total Sales 2010-11/ 2009-10/ % Growth Desktops 6,200,000 5,525,992 12%

Notebooks 3,150,000 2,508,564 26%

Total PC 9,350,000 8,034,556 16%

Link to fuller PDF report:

http://www.mait.com/admin/enews_images/eNL%20on%20Annual%20Industry%20Peformance%202009-10.pdf

Aug 1 2010