By David Poole, Director of Business and Brand Strategy, SapientRazorfish

(with contributions from Greg Boullin, Head of Digital Product Innovation, Strategy Director at SapientRazorfish)

July 26 2017: The evolving consumer is perhaps the biggest single driver for change. This new, global consumer — connected, smartwatch-wielding, and always on — is having a profound impact on the banking ecosystem. To better understand this new behavior, we surveyed approximately 500 smartphone-users in early 2016 to understand how frequency, convenience, and security are playing a role in reshaping the mobile payment market – and what that means for banks.

How consumers are using mobile payments

Our research reveals extensive usage of mobile payments. The survey found that mobile payment usage continues to grow year after year, with more than half of respondents (56 percent) now using mobile payments. Among the 56 percent who now use mobile payments, in-store adoption jumped from 36 percent to 80 percent from 2015 to 2016 – a growth that is most likely linked to increasing feasibility, access, and comfort.

Among respondents who say that they’ve used mobile payments, we saw a large increase in usage – from 36 percent to 80 percent (for those who use it “a few times a month” or more). The percentage of respondents who “rarely” use mobile payments, on the other hand, dropped to just 6 percent.

In terms of driving forces, convenience is the number one reason why respondents use mobile payments. As a new alternative, developers and merchants must increase the accessibility and acceptance of mobile payments if they want to capture those consumers looking to make the switch from their traditional cash and credit methods. A secondary motivation (after convenience) was rewards, discounts, or promotions.

While some of our survey respondents understand that mobile payments have arguably better security, other consumers do not. Security is often cited as a major barrier to mobile payment adoption, and it was the most frequently cited barrier in our study, followed by acceptance/availability.

In fact, according to our research, banks – with higher consumer trust (43 percent) than any other player in the ecosystem – hold strong potential for growth and leadership in the mobile payment category. Our survey found trust to be the major impediment to retailers and technology companies becoming go-to sources for mobile payments. Only 1 percent of respondents cited retailers as the most trusted, while banks led the pack with 43 percent, followed by alternate payment service providers (such as PayPal and Square).

For retailers and technology companies, trust has proven to be one of the leading barriers to consumers’ acceptance and usage of their bespoke mobile payment options.

However, to avoid being sidestepped by novel players (e.g., technology start-ups) entering this lucrative space, banks will need to take several steps. They must:

How brands can prepare for the payment (r)evolution

No single brand has solved for every aspect of the payment experience. But, as technology and business model innovation change, bank executives must develop solutions that prioritize more real-time, convenient, contextual, and intelligent functionalities.

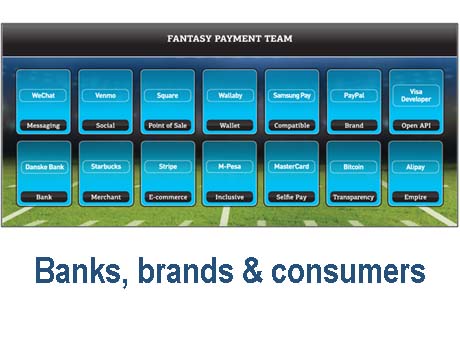

Banks can learn from leaders in each category, and integrate those features that matter the most to their customers in a way that’s true to their brands. Here are the 4 key trends from across the board:

Banks can even use technology like artificial intelligence. A simple example is a digital wallet, like Wallaby, that automatically selects which credit card maximizes rewards at the point of sale, avoiding the need to remember which category accrues the most points.

Conclusion: To be the primary way that we pay, mobile payments need to become easier and more top-of-mind than pulling out cash or a card. Indeed, while comparing data from 2015 to 2016, we discovered that convenience remains the biggest motivator, with one of the biggest deterrents being that few retailers even accept mobile

The vision of a unified, cashless, global payment experience is a long way off, but banks need to make progress toward that goal if they wish to remain relevant in the eyes of future, ever-smarter shoppers.

Sapient Razorfish, is a new breed of transformation partner that helps companies reimagine how they can organize, connect and thrive in the connected world using a customer-centric approach