Bangalore, September 14 2017: A Pune - based financial technology startup is proving to be a boon to young professionals who sometimes need a quick loan to tide over a temporary problem and have no time to go through the extended paperwork and due diligence of regular loan channels.

EarlySalary.com, now operates in 8 cities including Pune, Bangalore, Chennai, Mumbai, Hyderabad and Delhi NCR. The company provides instant loans from Rs. 8,000 up to Rs. 1,00,000 for up to 30 days. Applying is easy through an Android and iOS app that has seen half a million downloads and 25,000 loan disbursals.

EarlySalary allows an individual to get an instant credit limit against his monthly salary, which is available to him at anytime of the day or night. All he has to do is tap his phone to get his salary advance credited to his Bank account instantly. Keeping a credit line is free for the customer. On disbursal, EarlySalary charges Rs.9 per Rs.10,000 towards interest. The interest percentage is nearly half that of a credit card.

EarlySalary’s social media based underwriting system and machine learning platform allows even a person who is New to Credit (NTC) or Customer without Credit Bureau scores to borrow. Today for nearly 35% of customers, EarlySalary is their 1st line of credit.

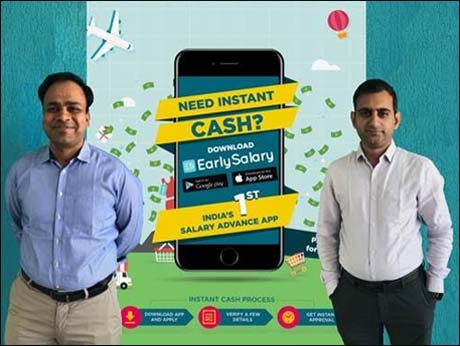

Says Akshay Mehrotra, Co-founder & CEO of EarlySalary: "There is a demand for lifestyle oriented products & to fulfil the lifestyle needs there’s a need for a service like EarlySalary."

Key Features include instant Salary Advance upto 50% of monthly salary in under 10 minutes; cash loans transferred to bank anytime instantly; cash loans from 7 days up to 90days; existing customer on repeat loans get 3 EMIs options and upto Rs.2

Akshay Mehrotra, CEO, previously served as the Chief Marketing Officer at Big Bazaar, Future Retail Limited, CMO at PolicyBazaar.com & Marketing Head at Bajaj Allianz Life Insurance . Ashish Goyal, CFO, is a chartered accountant by education and previously served as the Chief Investment Officer at Bajaj Allianz General Insurance.