In its haste to push people into going cashless, government rolls out one tool after another. As a result none of them has a sustainable ecosystem -- and banks are being caught off-guard.

IndiaTechOnline special

This article has appeared yesterday in THE WEEK

Bangalore, March 1 2017: There is such a thing as a surfeit of goodies -- and as doctors will tell you, that doesn't make for healthy living. This is a scenario being played out in the e-payments arena. Ever since demonetization was thrust on an unprepared nation 3 month ago -- leading to widespread trauma for ordinary Indians -- government would have us believe that nirvana lies in embracing e-cash.

On DeMon-Day, last September, it had no mature alternative schemes of its own on the ground. People embraced one of the closed or semi closed e- walletschemes like PayTM, MobiQwik, Free Charge, Ola money etc to get over the currency crunch.

Payment schemes using the official Universal Payments Interface (UPI) suffered in comparison because not enough banks were backing it. The banks which did have a UPI wallet ( ICICI Pockets, HDFC PayZapp) did not talk to each other or were not interoperable.

Late in December, government launched BHIM with much fanfare (Bharat Interface for Money). It was developed by the National Payments Corporation of India on UPI and needed just a mobile phone and a linked bank account to operate. People embraced BHIM, downloading 17 million copies of the app. But till end February only some 15 of over 100 banks had linked to BHIM. Not the biggies like SBI and HDFC.

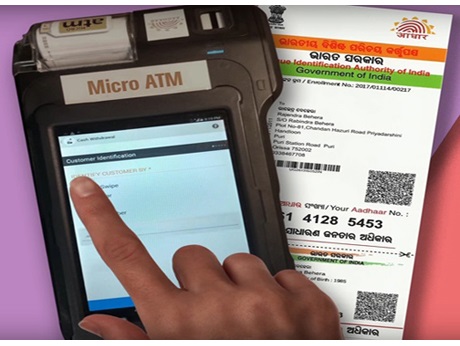

Then, there is the Aadhaar Enabled Payment System (AEPS) , where you don't even need a mobile phone -- only your Aadhaar-linked bank account. Problem: To authenticate, it needed a finger print or iris scanner. The latter cost Rs 13,000. The former was not fool proof. In rural areas and industrial towns, workers' fingers had roughened and their finger scans often gave error results. Authors of Aadhaar like Nandan Nilekani speak glibly of "no issues that are disproportionate to the size of the project". This is like saying you can't make an omelete without breaking some eggs. True, but sad! Aadhaar authentication is claimed to be 92% - 95% accurate. But these statistics miss the human cost. Just 1% error in Aadhaar verification disenfranchises 11 million persons.... people who will miss a quota of ration or a MGNREGA wage.

Most recently government has encouraged yet another payment technology, Bharat QR Code where payment is made to a merchant by scanning a QR code that is generated for the item sold. NPCI, Visa, Mastercard, AmEx, RuPay are partnering this. But ask yourself -- when did you last buy some item which has a QR code. Bar code yes, we are used to them in super markets, but QR code? Again banks have proved to be the laggards -- only some 14-15 are Bharat QR-ready.

But who can blame them? Government rolls out one payment scheme after the other -- none of them has time to mature, or has the numbers of merchants and financial institutions to create a well populated ecosystem. Banks are hard pressed opening their gates to one tool and the next is already knocking on their doors.

And in the breathless pace at which Aadhaar is being expanded, small matters of legality are brushed aside.

***

Vijay: Aaj mere paas paisa hai, bangla hai, gaadi hai, naukar hai, bank balance hai, aur tumhare paas kya hai?

Ravi: Mere paas Aadhaar hai!

If they were to remake that 1975 classic, 'Deewar', today, the guy playing the Shashi Kapoor role would flaunt his Aadhaar card rather than his mom, in reply to Amitabh Bachchan's taunt.

The Supreme Court in a September 2016 ruling did not dilute its earlier opinion that the unique identification number, Aadhaar cannot be made mandatory. But state and central government press on, regardless, making it obligatory for an ever increasing list of services. 'Governance Now' magazine listed 19 services from train concessions for senior citizens, to college admissions, where Aadhaar is required. Government knows how to go for the jugular: Aadhaar is mandated in cases where beneficiaries can't afford to argue: rations, MGNREGA benefits, LPG subsidies. So they sign up -- or starve.

Serious concerns have been by civil society about the security of Aadhaar data -- yet government has authorized nearly 600 agencies -- banks, government departments, telecom providers -- to perform Aadhaar based authentication.

Indian, jugaad has ensured that some of these agencies resold the data bases and clever people were marketing them in innovative ways -- for profit. Many of these enterprises have been blocked. Government even filed a complaint against Axis Bank for misusing such data -- albeit at the hands of a service provider.

Meanwhile, to even suggest that conventional payment avenues like ATMs and credit/debit cards may soon be obsolete and by implication could be scaled down-- as NITI Aayog CEO Amitabh Kant did some weeks ago --- is wishful thinking.

None of the half dozen government-blesses e-payment schemes today are robust or sufficiently ubiquitous to fill the breach. Instead of announcing a new scheme every week, it would be better to home on to one compelling app, bend on banks to support it to the hilt, reduce the transaction cost to merchants to almost zero -- and then and only then, sing all those hosannas to a cashless, digital India.

Anything else, is so much hype and hot water.